Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIndiabulls Ventures Ltd (NSE:IBVENTURES) is a leading capital market company in India. It provides securities, commodities and derivative broking services to its clients. The company is a pioneer of the online trading platform in the country and engages in offering investment solutions across diverse asset classes. It is known for its fastest and most efficient trading platforms in the country and serves a huge base of more than six lacs clients in more than 18 cities in India. Indiabulls Ventures is a part of the Indiabulls Group, which is one of the country's leading business houses with interests in housing finance, real estate, securities, personal financing, construction equipment leasing, and facilities sector.

Positives

i) Profitable Subsidiaries - Indiabulls Ventures acts as a stockbroker, depository participant, research analyst, and merchant banker. The company’s subsidiaries include IVL Finance Ltd, Indiabulls Asset Reconstruction, and Indiabulls Investment Advisors Ltd. IVFL provides personal, business and other loans, while Indiabulls Investment offers a diverse range of residential properties across the country. Given its interrelated businesses, Indiabulls Ventures is in a good position to cross-sell its products to existing and new clients.

ii) Attractive Products and Solutions - Indiabulls’ Dhani is an online personal loan fulfillment offering which provides money directly in the customer bank accounts. It is also engaged in the marketing of non-discretionary wealth management products through its subsidiaries. Indiabulls Ventures is focused on investing in digital lending models and leverages technology to optimize operations and enhance the customer experience. This has enabled quick app based disbursals reducing the operating costs for the company. The company provides an option to choose in between online as well as broker-assisted trading facilities to its clients. It also provides personalized portfolio tracking and real time quotes. Indiabulls ventures recently launched Shubh, its next generation trading platform. All these initiatives make Indiabulls Ventures a preferred trading partner for the masses.

iii) Set To Benefit from the improving Indian Landscape - Indiabulls’ businesses stand a good chance to benefit from the increasing consumerism, improving lifestyles and increase in income of Indian households. The company has witnessed strong growth in FY 2018 with the personal loans book increasing at a CAGR of 27%. According to Boston Consulting Group’s report, digital lending could top $1 trillion over the next five years. Indiabulls Investment Advisors assist home buyers to meet their home and investment needs through its large portfolio of residential projects in all major cities. Its asset reconstruction business should also gain from the government’s target to resolve the stressed assets situation in the banking industry. A reform oriented BJP government at the center, should also act as a tailwind for the company.

iv) Should Gain from the Formalization of the Indian economy - The Indian stock market is on a strong run over the last couple of months as the prospects of a strong pro-business political dispensation ruling over the next 5 years have excited investors. There is a feeling that the Indian economy can grow at 8% after a couple of years as the Modi government is expected to enact strong pro-growth measures. While the economy has slowed down in recent quarters, the stock market has shot to all-time highs. Amongst assets, equity has been one of the best performing ones amongst gold, fixed income, real estate, etc. with the increasing formalization of the Indian economy with measures like the GST being taken during the last 5 years. The penetration of equity ownership amongst Indians is also quite high compared to other developed markets which provide another tailwind for stock market-related companies like Indiabulls Ventures Ltd.

Challenges

IVL Finance is exposed to credit, interest rate, and liquidity risk. In addition, rising crude oil prices could lead to inflation which could adversely impact the consumption and investment pattern and cost of borrowing in the country. Rising NPAs has also led to a slowdown in the overall banking system. Competition from leading private bank’s securities arm such as HDFC Securities poses a big threat to the company, as these banks are in a better position to cross-sell their products to their existing clients. Investors also generally prefer to link their bank accounts with their trading accounts. However, Indiabulls Ventures’ early mover advantage is a big plus for the company.

Valuation

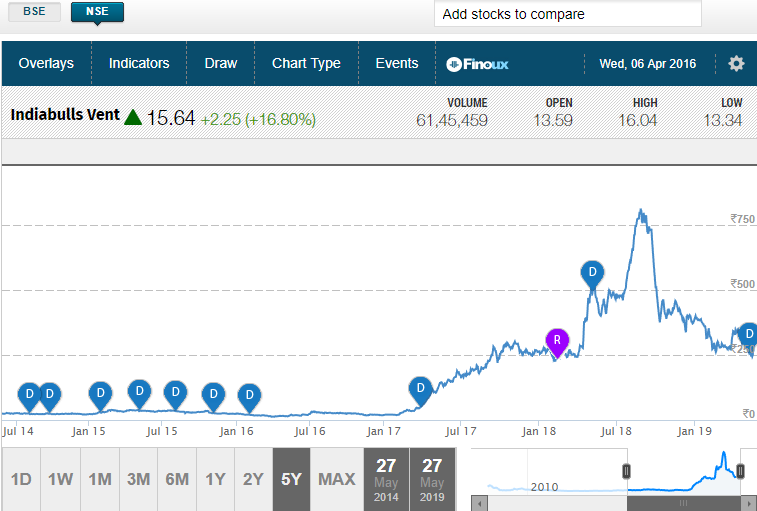

Indiabulls Ventures has a market capitalization value of Rs. 18,900 crores and is trading at 41 times its earnings, which is slightly expensive when compared to an industry average of 33x. The stock is trading near Rs. 300 mark, which is 60% below its 52-week high price, reached in July last year. The stock has grown by more than ten times in the last five years. The company has a good return on equity track record with three years’ average ROE of 21.16%. It has also maintained a healthy dividend payout of 56% over the last three years.

Source: Money Control

Conclusion

A growing base of individual customers and MSMEs looking for capital funds in India act as a strong tailwind for the company. Indiabulls Ventures’ expertise in providing investment solutions to retail investors across all asset classes differentiates it from peers and makes it a leading capital market company in India. With the BJP-led NDA government coming to power, the country is expecting increased economic reforms and foreign institutional investments. Sectors such as housing finance and infrastructure should also benefit. Indiabulls Ventures should gain from these structural as well as economic reforms, given its popularity as a leading brokerage and consumer finance company in the country. Its investments in analytics and technology will provide a competitive edge over traditional players in the country.

share your thoughts

Only registered users can comment. Please register to the website.