Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINQuick Heal Technologies Ltd.

Quick Heal Technologies Ltd. (NSE:QUICKHEAL) is a leading IT security solutions company in India founded in 1995. The company engages in providing security solutions that include antivirus software, firewalls, antispyware and data protection etc. The company provides a host of IT service solutions for various devices and platforms. Over the years, Quick Heal has developed an efficient sales and distribution network consisting of distributors, channel partners, resellers and system integrators. It operates in 36 cities in India and also has an international presence, with offices in over 40 countries.

Quick Heal is a leading name in the IT security solutions space and caters to the needs of diversified consumers ranging from small businesses to Government establishments and corporate houses. The company operates through Retail (which account for 80% of total revenues) and caters largely to the home PCs, desktop and mobile segment; and Enterprise & government solutions (20% of total revenues) that caters to small and medium businesses, enterprises and government.

Quick Heal Pros

i) A host of computer and network security solutions - With nearly 25 years of experience, Quick Heal Technologies has developed a wide range of solutions for computers and network security. The company has extensive R&D facilities and the security solutions have been indigenously developed in India. The company’s spend on R&D has increased to 18% of revenues from just 8% over the last six years. Quick Heal Antivirus Solutions, Quick Heal Scan Engine and the entire range of Quick Heal products are proprietary items of Quick Heal Technologies Ltd. The company has also developed the gen-next portfolio of cloud-based security and advanced machine learning enabled solutions.

ii) Strong Brand Name and Quality products - Quick Heal is known for its strong customer-focused approach and outstanding quality. The company focuses on providing convenient and trustworthy solutions for security against real-time risks. These solutions can be easily run on multiple platforms like laptop, desktop, notepad, mobile, and server. Quick Heal enjoys 34% market share in the retail segment. Quick Heal products have been voted as the 'Most-Preferred' AntiVirus brand by CRN Channel Champions. Its brands Quick Heal and Seqrite are prominent and renowned names in the IT security industry.

iii) A strong base of loyal customers - Given, Quick Heal’s strong customer friendly approach and quality of products, the company has developed strong customer relations over the years. The company has nurtured deep industry and domain expertise which has helped it develop a robust network and content security solutions for personal computing, SMEs, Government establishments and corporate networks. Quick Heal caters to customers in a wide range of industries including manufacturing, BFSI, healthcare, hospitality, education, government, e-commerce etc.

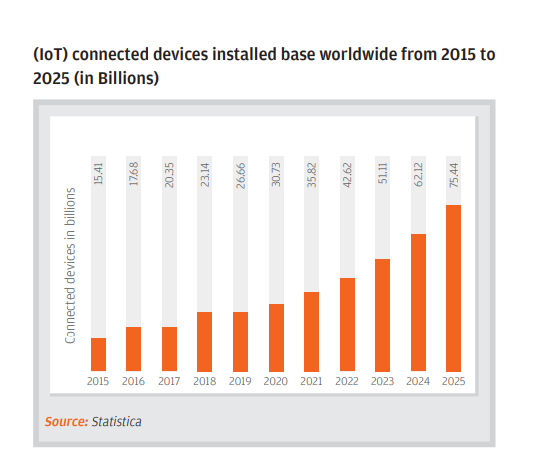

iv) Demand for Quick Heal solutions is on the rise - As we rapidly move towards a more digital world, the demand for securing our computers and network is bound to rise. Trends such as ransomware attacks, increase in threats to mobile devices, and increased usage of IoT and AI by cybercriminals are growing at an alarmingly fast pace. By 2022, India’s digital economy is expected to grow to USD 1 trillion and six billion people are expected to be vulnerable to cyber attacks. It is impertinent for businesses to protect their information and interactions on all types of networks and devices globally. Quick Heal is a reputed company and has earned the trust of millions of customers. Till date, the company has installed more than 24 million products and has an active license user base of 9 million and 30,000 enterprise customers.

Source: Quick Heal Investor Presentation

Risks

The IT security market is very competitive. The company faces intense competition from national as well as international companies such as Symantec, Trend Micro, Kaspersky, McAfee, Sophos, Fortinet, Apps Daily, Syska, K7 etc. In addition, Quick Heal also competes with the likes of Microsoft, Cisco Systems and IBM, HP and Lenovo who incorporate security functionality into their products.

Valuation

Quick Heal was listed on BSE and NSE in 2016. It has a market capitalization value of INR 1570 crores currently and is trading near the INR 220 mark with a trailing P/E of 19x. The stock had hit a 52-week low in February this year. The company’s board recently approved a share buyback offer, which sent the stock surging 4%. The buyback price is Rs. 275 per share. The promoters have expressed their intent to participate in the buyback tender. They currently own over 72% of the total shareholding. The share buyback is a good short term opportunity for investors and also demonstrates management's trust in the company. Not only that Quick Heal also offers a good long term investment opportunity on the back of strong digital growth in India and its solid reputation as a leading digital security solutions provider in the country.

Stock Performance in the last six months

Source: MoneyControl

Conclusion

Quick Heal is a leading provider of innovative security and data protection solutions for individuals, businesses, and government. As the internet becomes an indispensable part of our lives, the demand for digital security is on the rise. Innovation-driven research and development, customer-friendly solutions, a strong brand reputation are Quick Heal’s strong competitive advantages. The company is looking at expanding its customer base and offering more competitive products through strengthening its R&D, expanding mobile capabilities and international expansion. A growing trend of internet penetration in India should act as a tailwind for the company.

share your thoughts

Only registered users can comment. Please register to the website.