Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINEicher Motors Limited (NSE:EICHERMOT) is a leading automotive company in India. It is a flagship company of the Eicher Group, formed in 1982. The company has been credited with producing India’s first agricultural tractor in 1959. Since then there has been no stopping. Today Eicher Motors is the proud owner of Royal Enfield motorcycle business, which is a top premier motorcycle in the country. The company also manufactures and markets other vehicles as a partner in a number of joint venture businesses with leading global industry players. Eicher Motors is also expanding its business globally which should further increase profitability.

Royal Enfield, growing market share and expanding capacities and portfolio are Eicher Motors key competitive strengths. Let’s look at them in detail:

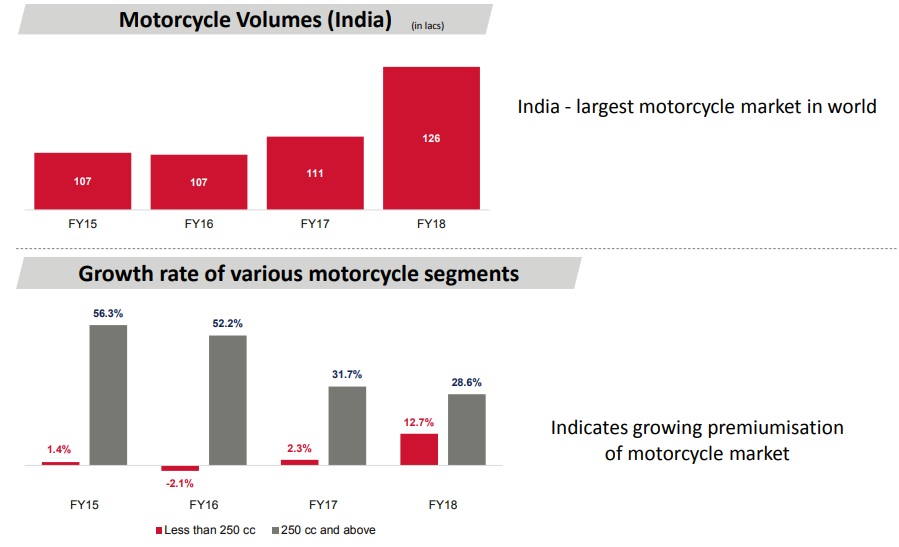

i) Leading market share positions in growing Indian market – Eicher Motors continues to be a market leader in the mid-size motorcycles segment, with Royal Enfield commanding more than 90% market share. The company sold over 800,000 bikes last year, almost 7x sold in the last six years. The company also had a 32% market share of VE commercial vehicles in the domestic light-to-medium duty segment and a 4.6% market share in the heavy trucks segment last year. The segment is targeting a sales growth of 50% this year. The company is well positioned to benefit from a large presence in India which is the largest motorcycle market in the world. The premium segment of motorcycles, in which Royal Enfield commands a leading position, is also expanding. India has favorable growth demographics with rising trends of urbanization and increased discretionary spending.

Source: Eicher Motors Investor Presentation

ii) Owner of the Royal Enfield Brand – Eicher Motors owns one of India’s leading premier motorcycle brands – Royal Enfield, which is witnessing a huge surge in demand in the recent past, nearly 50% growth per annum over the last 3 years. Acquired in 1991, Royal Enfield is known for creating distinctive modern classic bikes and is popular not only in India, but has also become a well-recognised brand in the global mid-size motorcycle market. Royal Enfield has a growing international footprint in the USA, Japan, UK, Europe and Latin America, as well as the Middle East and South Asia. The brand has an increasing loyal base of customers consisting of traditional to urban, aspiration-driven youth.

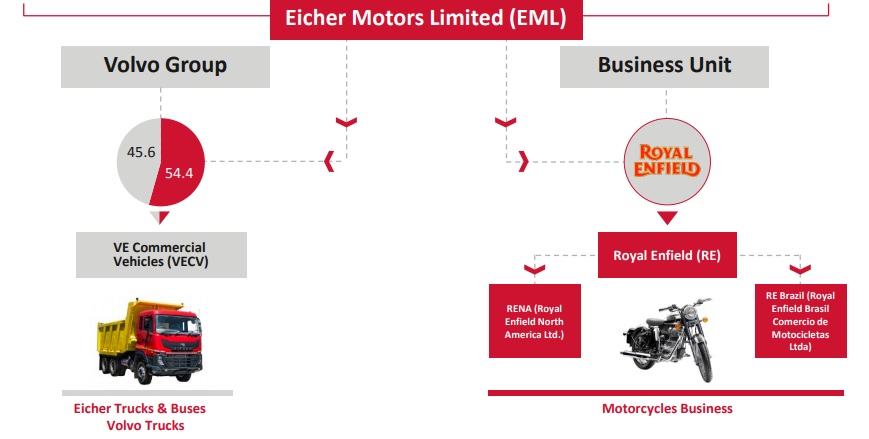

iii) Broad product portfolio –In addition to the star of the product portfolio, Royal Enfield, Eicher Motors also owns a large portfolio of other commercial vehicles. This includes a complete range of Eicher branded trucks and buses, VE Powertrain. The company operates through two broad business units – Royal Enfield and VECV (VE Commercial Vehicles). In addition, Eicher Motors also has components and engineering design services businesses, the sales and distribution business of Volvo trucks as well as aftermarket support to Volvo buses in India. In 2005, the company divested its tractor and allied businesses to focus on commercial vehicle and motorcycle businesses.

Source: Eicher Motors Investor Presentation

iv) Operational excellence and customer relations - The company has been present in India for the past five decades and has witnessed the transformation in the Indian automobile industry. This rich heritage and experience have made Eicher one of the most trusted brands in India. Over the years, Eicher Motors has gained in-depth customer insights and market understanding. It has also developed extensive relations with suppliers, mastered operational excellence and global quality standards. Eicher Motors also has huge distribution networks and low-cost supply chains which further improves operations.

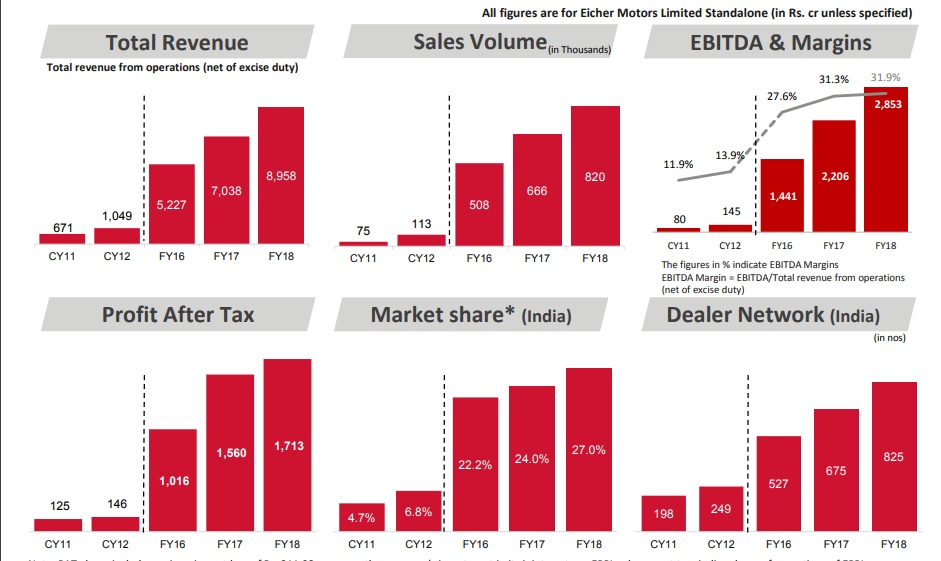

v) Improving Metrics – Eicher Motors has delivered an improvement in financial metrics as can be seen below. The company has also planned INR 800 crores of capital expenditure till FY19 for capacity expansion and development of new products. Eicher plans to expand its capacity to the level of 825,000 units of Royal Enfield in FY18. Its new plant has already commenced production in August 2017 in Chennai. The management expects to increase capacity further to 900,000 units by FY19. Driven by the overwhelming response of Royal Enfield, Eicher launched Interceptor 650 roadster and the Continental GT 650 cafe racer in the 250-750cc motorcycle segment. The company reported 24% growth in the March quarter. It also spends a fortune on brand building activities in order to connect with people passionate about motorcycles.

Challenges

One of the most prominent challenges for Eicher Motors is the growing dependence on its star product Royal Enfield. The share price of Eicher has suffered earlier this year, given a slowdown in Royal Enfield sales growth. Growing dominance on a couple of models like Classic and Bullet might also prove harmful for the company in case of volume growth decline. Though sales of commercial vehicles (VECV segment) are poised to grow, the operating and net profits from this segment is still very low.

Changing consumer trends, electrification of vehicles can affect the numbers. According to Amitabh Kant, the CEO of NITI Aayog, cost of electric vehicles will be at par with conventional vehicles by 2026. He also suggests promoting electrification not only in the cars but also in two and three wheelers. Though Royal Enfield is a leader in the growing mid-sized motorcycle segment, it is not keen on replacing its engine with an electric powertrain, at the moment. It wants to wait for the market changes before adopting electrification.

Another growing challenge for Eicher Motors is the increasing competition in the two-wheeler segment by other leading brands like Bajaj Auto, TVS Motor, Hero MotoCorp, Suzuki, Yamaha, Harley Davidson and other new entrants in India. While demand for premium bikes is increasing, the number of companies in this segment is also growing. Eicher Motors might lose its virtual leadership position in future.

Valuation

Shares of Eicher Motors have rallied from near INR 3500 levels five years ago, to INR 27,700 at present – that’s a whopping ~80% increase. The company has a market capitalization value of INR 75,500 crores and sports a P/E of 38x, which is at a slight premium compared to its peers (34.5x). The shares are currently trading 15% below its 52-week high price. Eicher Motors’ shares rank amongst the five most expensive shares trading on the Indian stock exchange. The company deserves premium valuation given its solid business and brand name.

The most striking feature about Eicher Motors is its strong and unlevered balance sheet. The company remains debt free. Eicher Motors became a part of the Nifty 50 Index, which consists of 50 diversified stocks from twelve different sectors of the economy and reflects the overall market conditions in India.

Conclusion

Eicher Motors is a dominant industry player with a competent management. Product quality, customer satisfaction, brand name and an evolved business model form a strong moat around Eicher Motors’ business. The company is already a leader in the mid-weight segment and continues to grow despite all odds. Capacity expansion, new launches, recovery in key domestic markets, expansion of dealer network and strong volumes for commercial vehicles should boost margins. Under-penetrated rural markets also pose a strong market for Eicher Motors. Moreover, if Eicher can successfully establish a niche market globally, it might provide the much-needed push. Eicher Motors’ shares are one of the best performing Indian stocks with high compounded annual growth rate. Though the share price is high, fundamentals command a high valuation.

share your thoughts

Only registered users can comment. Please register to the website.