Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

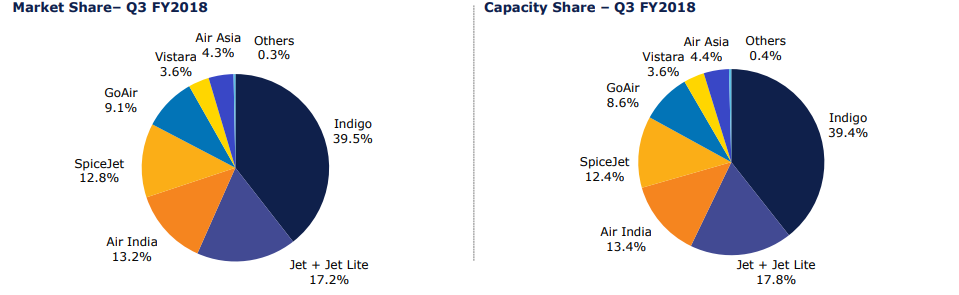

Jet Airways Ltd. (NSE:JETAIRWAYS) is one of India’s leading private international carrier company. With 25 years in business, Jet Airways has become a full-service airline with growing popularity in the country. It is the second largest airline in India behind Indigo, in terms of both market share and capacity share, operating flights to 65 destinations, including India and overseas.

However, as the second largest player in the world’s fastest-growing aviation market, Jet Airways has not been doing things differently. Jet Airways Ltd. was the dominant leader in the domestic market till 2012 until IndiGo took the leading spot as India’s most preferred airline with low fares and high quality. Indigo has become a clear market leader with 40% market share, from just 12% a decade ago, while SpiceJet is fast catching up.

Let’s have a closer look at Jet Airways.

Jet Airways Positives

i) A large domestic presence - The company has been busy adding new routes and connecting Tier II towns to major metro cities in India. It announced introducing 144 weekly flights from this summer, some of them being unique routes. Jet Airways is also providing convenience and flexibility to its guests in the form of JetAdvance, Fare Choices, Baggage Drop and Global Pass. The airline company also rolled out an internet-enabled wireless streaming in-flight entertainment system.

ii) Growing Fleet – Jet Airways has a fleet consisting of 120 modern, reliable and fuel efficient aircraft comprising Boeing 777-300 ERs, Airbus A330-200 / 300, Next Generation Boeing 737s and ATR 72-500/600s. The company has also placed an order for 150 fuel efficient Boeing 737 MAX aircraft for delivery starting in June 2018 onwards.

iii) Growing international Presence - The company keeps entering into new alliances and partnerships with other airline companies globally, with 21 codeshare and 32 frequent flier partners. Some of its global partners are Etihad, Air Canada, Emirates, Virgin Atlantic, KLM, Qantas etc. These partnerships have enabled Jet Airways to extend its wings to international destinations worldwide including key cities in Europe, North America, Middle-East and Asia.

iv) Robust growth in the Indian aviation sector – The Indian aviation sector is poised to grow at a rapid pace because of growth in GDP, higher disposable incomes and a growing young and aspirational population. India is projected to become the world’s third largest aviation market by 2026, behind China and the US. Several initiatives by the government like the Regional Connectivity Scheme (UDAN), smart cities and simplification in visa rules and procedures should further boost the industry’s progress.

Risks

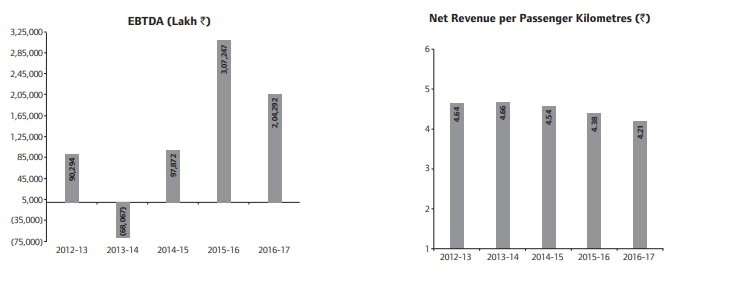

a) Disappointing Quarterly results - On a standalone basis, Jet Airways reported a 46% y/y drop in net profit in the December quarter, despite a 10% increase in revenue from operations. Higher aircraft lease rentals, high fuel, and employee costs were cited as the major reasons for an increase in total expenses.

Source: Annual Report

ii) Heightened Competition – Jet Airways operates in a highly competitive Indian aviation industry. Indigo commands a larger market share of the aviation market at ~40% and is way ahead than Jet Airways with a 17% market share. SpiceJet with a 12%+ market share is also fast closing in. Vistara is poised to contest Jet Airways on long-haul routes in the coming years.

iii) Company specific problems - The company also suffers from its own set of problems with the last four years witnessing management change in the form six CEOs. There have been reports about internal tiff amongst the staff members too. Deferment of salaries also led to employee dissatisfaction. Moreover, there are rumors about Etihad selling its 24% stake in Jet By December this year. If this turns to be true it might add to the company’s concerns.

iv) Rising Crude oil prices - Rising fuel prices have been a major headache for airlines, adversely affecting profitability. Fuel prices constitute the largest part of operating costs and are also beyond control. In fact, the company reported a 29% increase in fuel expenses in its latest quarter. Moreover, the IOC has further hiked jet fuel prices by more than 6% effective May 2018. Shares of Jet Airways fell 1% on this news. The aviation sector in general also fell after Indigo reported disappointing fourth quarter results and resignation of its CEO. The industry is expecting Jet Airways and SpiceJet to follow suit as they gear up to report their Q4 results.

Stock Performance & Valuation

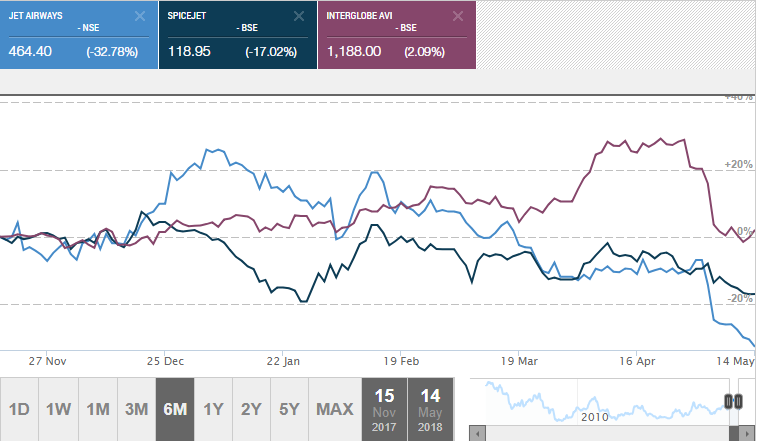

Jet Airways shares are currently trading at depressed levels near INR 460, almost 50% lower than its 52-week high. It has a current market capitalization value of INR 5,258 crores and a trailing P/E of 12x, which is lower than the industry average of 18x. The valuation looks cheap, however, the stock performance has been worse than peers like Interglobe Aviation Ltd. (NSE:INDIGO) and SpiceJet Ltd. (NSE:MODILUFT) as can be seen below.

Source: Moneycontrol

Conclusion

India is a highly lucrative market with huge untapped potential and growing air passenger traffic. However, the industry is currently witnessing testing times. Jet Airways is the oldest private sector airline in the country and the first to fly internationally. However, higher crude oil prices and severe pricing pressures have become the major concerns for the aviation company currently. The price of shares could decline further given the upcoming quarterly result. At present, Indigo and SpiceJet are better buying options in the Indian aviation sector, in my opinion. While Indigo is the largest Indian player with an impressive domestic network representing a huge share of the market, SpiceJet has proven its resilience by completely turning around from a dwindling reputation to becoming one of India’s most preferred airlines.

share your thoughts

Only registered users can comment. Please register to the website.