Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINCEAT Ltd. (NSE:CEATLTD) is one of India’s leading tyre manufacturers, producing over 26 million tyres a year and commanding a 12% market share. It is the flagship company of RPG Enterprises, one of India's largest industrial conglomerates. CEAT has a strong global presence and is known for the quality and strength of its tyres worldwide. It manufactures tyres suitable for farm vehicles, commercial vehicles, passenger vehicles and two wheelers. The company has six manufacturing units and a Research & Development center in Halol. CEAT should benefit from the increasing demand of vehicles both in India and abroad. Let’s take a look at the company’s strengths.

CEAT Positives

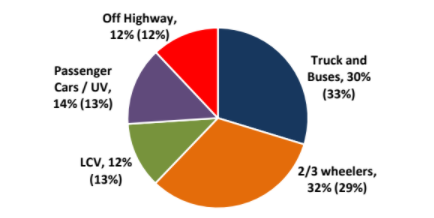

i) A wide portfolio of differentiated products - With six decades of existence, CEAT has developed a strong portfolio of tyres suitable for almost all vehicles. Its wide range of tyres is apt for all the means of road transport - heavy-duty trucks and buses, light commercial vehicles, earthmovers, forklifts, tractors, trailers, cars, motorcycles, and scooters as well as auto-rickshaws. CEAT is focusing on selling more volumes in the three-wheeler, passenger car segment and motor-cycle which is driving the market currently. India is poised to launch electric vehicles in a big way and CEAT tyres were fitted on India’s first premium electric bike Tork T6X.

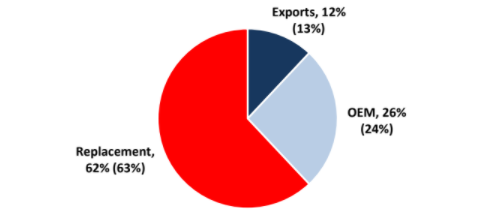

Source: CEAT Presentation

The company has developed puncture safe, fuel smart and milaze tyres which are breakthrough products in the vehicle market. It is developing smarter products and is constructing a 2W Smart plant at Nagpur. CEAT has also invested heavily on R&D in the last few years.

ii) Extensive distribution network and Solid customer Base – CEAT has an extensive distribution network consisting of more than 4500 dealers in over 600 districts, 250+ two-wheeler distributors, 350+ multi-brand outlets and 450 franchisees all over the country. The company also exports tyres for trucks, OTR and light commercial vehicles categories to over 130 countries in seven different clusters, and is expanding its global footprint.

With its rich experience, CEAT has developed strong relationships with its customers who include the best automobile manufacturers in the country like Tata, Honda, Hero, Mahindra, Hyundai, Suzuki etc.

iii) Strong Brand Name – CEAT has developed an impeccable reputation for high durability and quality. The company has a strong brand recall not only in India but more than 100 countries worldwide. It is the No.1 player in Sri Lanka in terms of market share. CEAT is poised to benefit from an increased demand for two-wheelers, passenger and utility vehicles in India; and off-highway tyres in international and emerging markets.

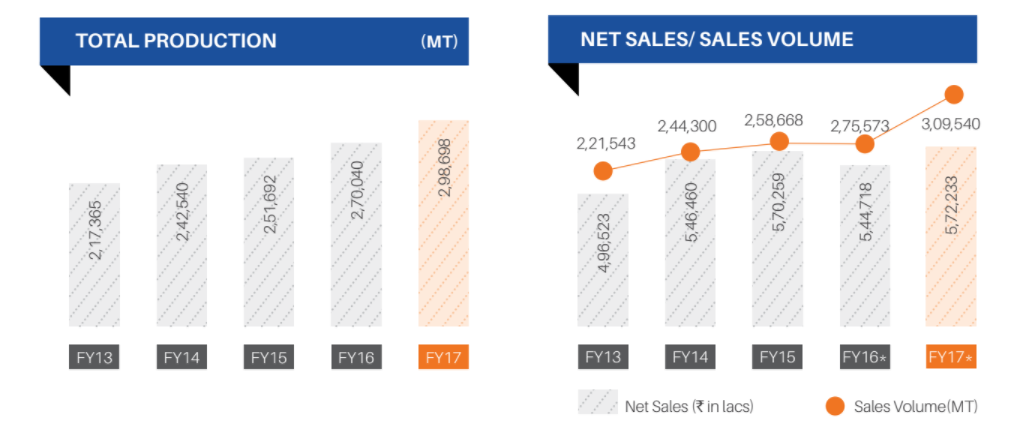

iv) Improving Metrics - CEAT’s net revenues increased by more than 12% y/y. The company is the fastest growing company in the industry in terms of revenue growth over the last five years. The company’s long-term credit rating has been upgraded to AA by CARE and India Ratings & Research.

Having a leading market share in the country, CEAT should also leverage from the fact that India is the fastest growing major economies in the world. The global tyre industry is valued at over $80 billion which provides CEAT a huge potential to grow.

CEAT needs to continually invest heavily in increasing capacities and R&D as the tyre industry is highly capital intensive. The company has made commitments to invest INR 2,800 crores over the next five years.

Risks

High cost of raw materials like rubber, nylon tyre fabric, and carbon, comprising of 65%-70% of total manufacturing cost, is also a major concern for CEAT. The share price is highly influenced by rubber prices. Back in January shares of tyre companies gained on falling rubber prices. Any change in their prices could have a negative impact on the company’s profitability. Moreover, dependence upon import of raw material like rubber and India’s inverted duty structure further encourage cheap tyre imports. Prices of rubber are expected to fluctuate in case of an anticipated US-China trade war, as China is the largest exporter of tyres in the world market. Moreover, the Indian manufacturers will suffer if China dumps its surplus stock in India.

About 12% of CEAT’s revenue is from exports. The company, therefore, suffers if there is any turbulence globally. Moreover, Chinese imports continue to pose a huge threat to India’s tyre industry across all categories.

The company also faces competition from other industry leading names like JK Tyres, Apollo Tyres Ltd., and MRF Ltd.

Stock Performance & Valuation

CEAT is currently trading near INR 1560 levels, just 10% above its 52-week low price. The shares have fallen by more than 20% so far this year, after reaching its 52-week high in January. Though this gives a good opportunity for investors to buy, CEAT’s trailing P/E stands at 27x which is higher than the industry average. The market capitalization value is more than INR 6,300 crores. CEAT’s beta is low at 0.12, which means the stock should perform consistently during market fluctuations when compared to others.

Conclusion

CEAT is a leading tyre manufacturer in India offering best in class tyres across all categories. It is poised to become a leader in the passenger vehicle segment over the years to come. The company is heavily investing in brand building, innovative product development and extensive expansion of its distribution network. It also stands in a good position to benefit from a strong growth in the passenger cars, utility vehicle and two-wheeler segments in India and international markets.

The tyre sector has been on a roll over the past few years. The industry is highly sensitive but given CEAT’s low beta and its good past performance, the investment should be a good way to benefit from growing automobile demand.

share your thoughts

Only registered users can comment. Please register to the website.