Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

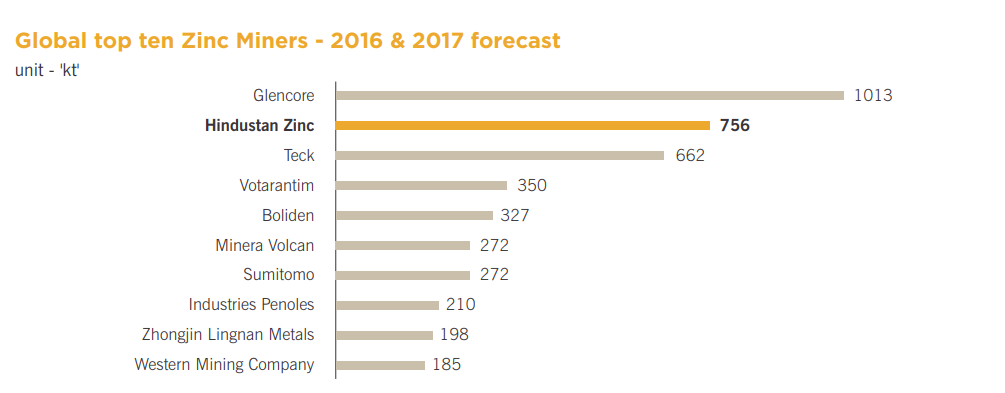

REGISTER NOW OR LOGINHindustan Zinc (NSE:HINDZINC) is the second largest producer of zinc globally behind Glencore. It is a large integrated producer of zinc, lead, and silver. Vedanta Ltd., a diversified natural resources company, holds 65% stake in Hindustan Zinc while 29% is held by the Government of India. Hindustan Zinc engages in mining and smelting of zinc and lead along with captive power generation. The company has an impressive portfolio of mines with long life and low cost, providing visibility across the demand and supply chain. It should further benefit from rising demand, as zinc is an essential metal for the construction industry and the fourth most consumed metal in the world. Its cash rich balance sheet and operational efficiency have made Hindustan Zinc a shareholder friendly company, paying huge dividends and maintaining high profit margins.

Hindustan Zinc Positives

i) The lowest cost producer in the world – Hindustan Zinc runs a metal production unit with an annual capacity of more than 1 MT. It also owns key lead-zinc mines, modern smelting complexes, and thermal captive power plants. The company’s flagship mine Rampura Agucha is the largest zinc- mine globally with a high ore grade which enables it to maintain a low cost of production. Hindustan Zinc is the only company in the country with three mines rated as 'five star' by Indian bureau of mines.

In addition, Hindustan Zinc also owns more than 325 MW of renewable energy power generation resources. The company is also developing technologies like digital mining, Integrated Transport and Contractor Workforce Management System, automation etc. that will help reduce environmental footprint caused by mining and smelting.

ii) Diversified Businesses – Hindustan Zinc is not only one of the largest producers of zinc worldwide but is also on track to become one of the top silver producers globally. Zinc accounted for 76% of total sales (in Q3’18), followed by lead (13%) and silver (9%). The company reported zinc, lead and silver production of 7.9 lakh tonnes, 1.68 lakh tonnes and 557 tonnes respectively for FY18 which represented a double digit increase each, year-on-year. These metals are expected to have an increasing demand in future given the increased investments in infrastructure projects and automotive sector.

iii) Benefit from growing Demand – Hindustan Zinc is in a good position to leverage from “Make in India” policy as the company enjoys a near monopolistic position in the country. The Indian government is also supporting domestic producers through measures like imposing Minimum Import Pricing, safeguard and anti-dumping duties etc. The modification of country’s infrastructure like setting up of smart cities, construction of highways and modernization of railways will also go a long way in boosting demand for locally produced zinc. The company contributed INR 17,760 crore to the Government treasury in FY17. Global zinc demand is also forecast to grow at a steady rate of 2% in 2017. Hindustan Zinc should also benefit from reduced global mine supply and China’s reduced production due to environmental regulations and mine safety.

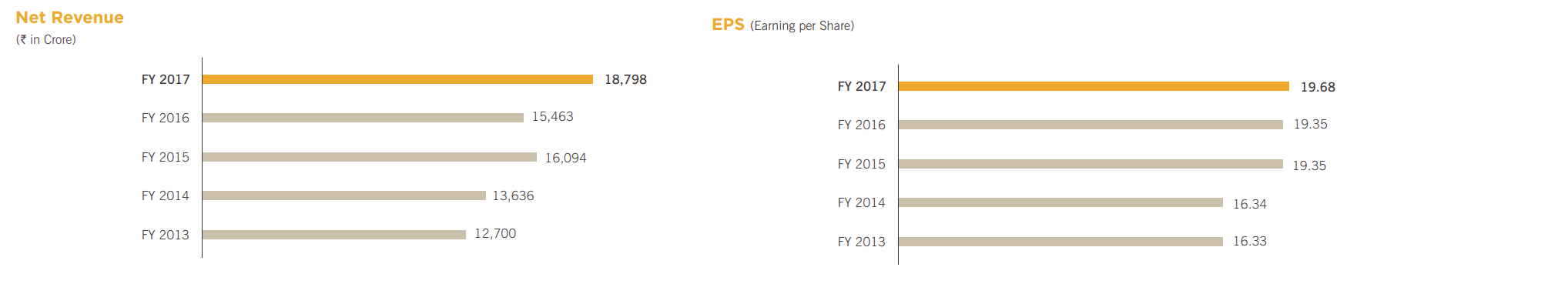

iv) Improving Fundamentals – The company achieved all-time high mined metal and silver production in FY17 while maintaining its operating costs through improvement in efficiency. It is also successfully transitioning from open cast mining to underground mining and achieved a five-year CAGR of 39% in its underground mined metal production. Underground mines contributed to 85% of total production until December 2017. Robust underground mine production and strong metal prices boosted EBITDA up 18% y/y. The company also has a strong balance sheet with surplus cash and zero debt.

Source: Hindustan Zinc Annual Report

The company is on track to achieve a mined metal production capacity of 1.2 MT per annum by FY20.

Risks

As the company transits to underground mining, declining output from open cast mining will be a key challenge for Hindustan Zinc to overcome, as it is essential for both volume retention and cost control.

Mining and metallurgical industry are energy intensive and the company relies heavily on diesel generators for power in remote off-grid locations, which has huge environment and cost implications.

Metals Sector is cyclical in nature. Fluctuation in commodity prices and the fact that commodity stocks undergo cyclical phases are other risks.

Stock Valuation

Shares of Hindustan Zinc have proved to be a multi-bagger trading at INR 330 levels currently, from INR 100 levels in 2013. The stock has reached a new 52 week high and the company has a market capitalization value of INR 133,520 crores. The shares are trading near a P/E of 13.75x, which is lower than industry average of almost 16x. The company also has a high dividend yield of over 9%. Very few companies in India have such high yield.

Conclusion

Being the largest and the most active mineral explorer in India, Hindustan Zinc ensures operational excellence and sustainability through long mine life of over 25 years, best in class asset portfolio and a low-cost structure. The company is the largest producer in the world behind Glencore and should benefit from increased zinc demand domestically as well as internationally. The stock is on a roll and the rally should continue over the long term, given reduced mine supply globally. Long term investors should take notice, but investors having a low risk appetite can have a short term outlook,

share your thoughts

Only registered users can comment. Please register to the website.