Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

With a 40% market share, Interglobe Aviation Ltd. (NSE:INDIGO) or IndiGo as we popularly know it, is India’s largest passenger airline. It is a low-cost carrier operating majorly in the Indian domestic market, connecting 41 domestic and 8 international destinations. With just a decade of existence, IndiGo has grown to become the most popular domestic airline carrier in India. Its asset-light and leased based business model assists in ample free cash flow generation. India is a huge market offering ample opportunities for low-cost carriers to grow in the domestic as well as international markets. As India’s largest airline carrier, IndiGo is in a good position to benefit from the growing Indian domestic air travel market.

IndiGo Positives

i) Impressive fleet – In just ten years, IndiGo has come a long way to becoming the leading airline company in the country operating more than a thousand flights per day. From humble beginnings starting with just one plane, IndiGo has grown to a fleet of 160 aircraft today, including 32 new generation A320 NEOs and 5 ATRs. High operational reliability and being on-time are the company’s USP. IndiGo currently operates flights connecting 50 destinations – 42 domestic and 8 international. The company is also planning to add almost 50 aircraft in FY 2018.

ii) Growing Popularity - IndiGo can be credited for completely transforming the air travel trend in India. The airline company has become popular for providing reasonable yet convenient and ample options to the Indians for commuting from one city to another. The company offers multichannel flight booking options ranging from call centers and airport counters to online flight booking and an exclusive Android app. IndiGo is also planning to expand its regional footprint with its ATR aircraft in India.

iii) Should Benefit from a growing Indian market - India is the third largest aviation market witnessing significant economic growth. The annual domestic traffic growth is about 15%-20% in India. The improvement in middle-class lifestyle and increase in consumer discretionary spending should boost the airline’s revenues in India. India also offers a lucrative international market opportunity. IndiGo was the first airline company in India to express an interest in potentially acquiring the international operations of Air India and AI Express, which could have further widened IndiGo’s international reach. However, given the government’s current divestiture plans for AI, IndiGo has put a halt on the idea.

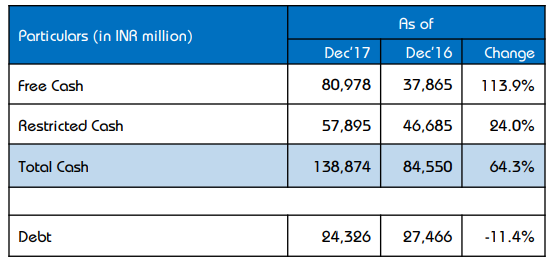

iv) Improving Metrics - IndiGo is not only the most efficient low fare operator domestically but also globally. It was ranked as one of the top 5 airlines (amongst the top 20 mega airlines) globally for on-time performance for the year 2017. The company reported a 50%+ jump in its profits and revenue increases by 24% in the latest Q3’18 results. IndiGo’s average PAX load factor is high at around 87% and it expects to increase its available seat kilometer metric by 24% in FY’18. IndiGo’s large volumes and increasing market share should be more than enough to ease margin pressures, as a result of rising competition. The company is also generating ample free cash flow and has low leverage as can be seen below.

Source: IndiGo Presentation

Key Risks

High competition is the biggest risk for IndiGo. India is a highly lucrative market with a huge untapped potential. IndiGo thus faces ample competition not only from old and established players but also new entrants who want to benefit from this situation. Though competition is intense, IndiGo is currently the leader in the Indian aviation market with 40% market share (from just 12% a decade ago), with peers at 13%-17% each.

There is some ambiguity around GST for airline carrier companies. For example, if you own/ buy an aircraft and import it, there is a penalty of 5% on it, while if you lease it (even from a foreign entity) you are entitled to offset those cost.

High fixed costs and rising crude oil price is another concern for the aviation company. IndiGo’s fuel cost per unit increased by ~14% in December quarter when compared to the earlier quarter. IndiGo’s operations were also negatively impacted by the grounding of three of its A320 Neo planes, which could further affect its capacity growth in future.

Valuation

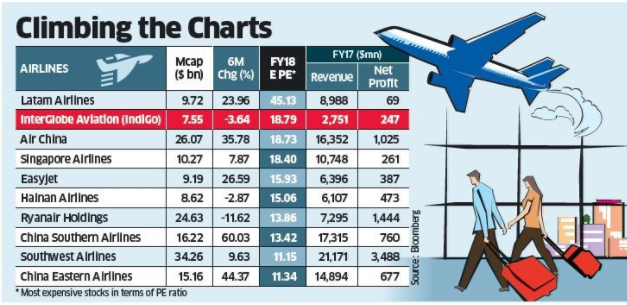

IndiGo is the second most expensive airline stock in the world, trading at 19 times its FY18 estimated PE.

Source: Economic Times

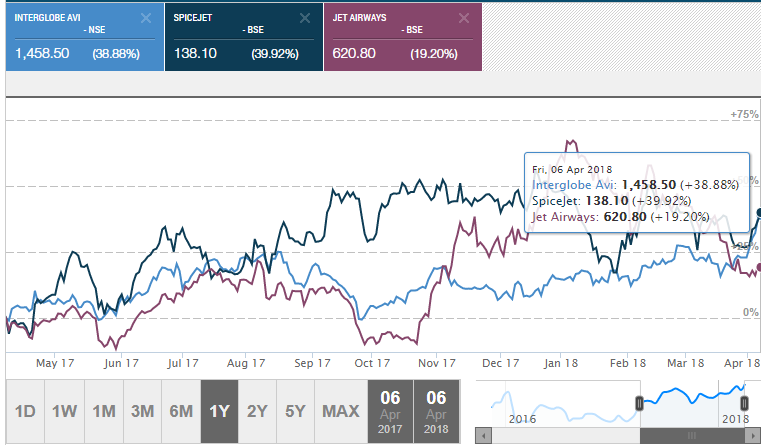

The stock is currently trading at INR 1450 level reaching new highs. The company has a market capitalization value of INR 56,000 crores, which encompass the market cap values of its peers by a wide margin. Jet Airways’ (NSE:JETAIRWAYS) market value stands at INR 7,050 crores while SpiceJet (NSE:MODILUFT) is valued at INR 8,200 crores. This means the market has great expectations from the company which has been priced in its share price.

IndiGo shares have returned ~40% to its shareholders over the last year which is equal to that of SpiceJet, but better than Jet Airways’ 21%.

Source: Money Control

IndiGo has been profitable for the last nine years in the intensely competitive Indian market and has also distributed $900 million in dividends over the last five years.

Conclusion

IndiGo is in a good position to unlock significant value proposition for its passengers as well as shareholders, given its operational efficiency and leading market share. Going forward, IndiGo should keep its pace of rapid growth in the domestic as well as international markets. The airline company has an impressive domestic network representing a huge share of the market. A solid balance sheet and free cash flow further provide more visibility to future investments and shareholder returns.

share your thoughts

Only registered users can comment. Please register to the website.