Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

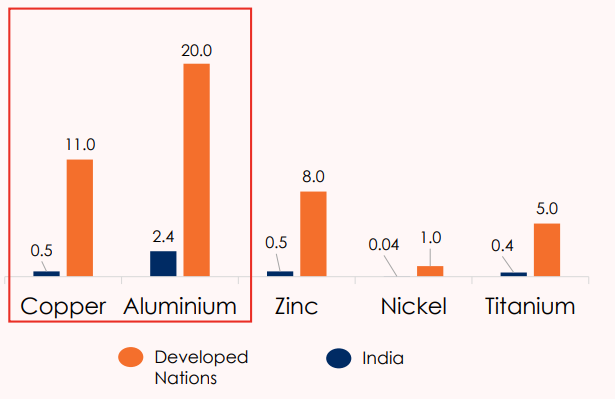

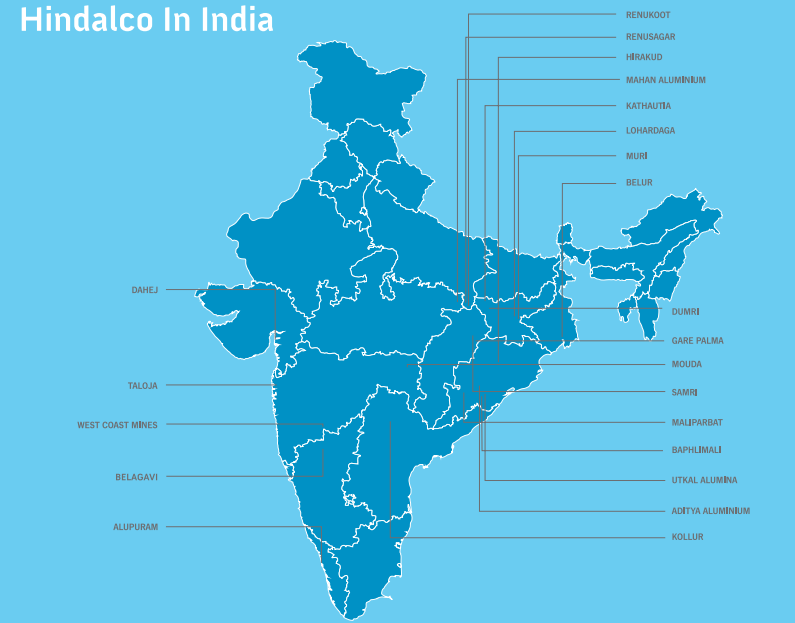

REGISTER NOW OR LOGINHindalco Industries Ltd (NSE:HINDALCO), is a flagship company of the Aditya Birla Group, which is one of the most reputed business conglomerates in India. The company is an industry leader in aluminum and copper. Hindalco is one of Asia’s biggest producers of primary aluminium. The company not only has a presence in India but also has global manufacturing in 13 countries across 6 continents and reaches customers in more than 50 countries outside India. Hindalco operates captive mines in Jharkhand, Chhattisgarh, Maharashtra, and Odisha. Its copper business, Birla Copper, is among the most cost-efficient producers of copper globally. The company should benefit from the untapped potential for non-ferrous metals in the Indian market.

Source: Hindalco Investor Presentation

Hindalco Positives

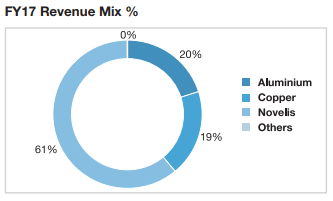

i) Diversified Business Profile - The company has diversified businesses consisting of aluminium, copper, Novelis, and others. Hindalco’s high margin but high volatility aluminium business is, therefore, supported by two steady cash flow businesses. Hindalco’s Freshwrap, Birla Balwan fertilizers, Maxloader, Everlast and Hindalco Extrusions are few of its leading brands. Hindalco is one of the leading sulphuric acid manufacturers and is also a fertilizer manufacturer. The company acquired Novelis, a world leader in rolled aluminium products, way back in 2007. It is also the leading supplier to large automotive brands like Ford, Jaguar Land Rover, and Cadillac. Novelis is shifting its focus to high margin products such as auto parts. The company is constantly expanding inorganically by investing globally especially in Asia to meet rising automotive demand.

Source: Annual Report

ii) Extensive line of manufacturing and state of art technology – Hindalco is a vertically integrated company having a presence in operations ranging from bauxite mining, alumina refining, coal mining, captive power plants and aluminium smelting to downstream rolling, extrusions and foils. Hindalco’s bauxite mines are located close to its manufacturing units. The company has secured long-term availability of coal through linkages and captive mines. Its state-of-art copper facility comprises a world-class copper smelter and a fertilizer plant along with a captive jetty. Its copper smelter is one of the world’s largest custom smelters at a single location. Since its inception in 1958, Hindalco has reached capacities of over half a million tons each for aluminium and copper and 3 million tons of rolled products at Novelis.

iii) Competitive Financials - The group’s solid reputation, robust financials, competitive management teams and operational excellence are its core strengths. New plants continue to operate at designed capacity and efficiency. Further, the company is also focusing on strengthening its balance sheet by deleveraging and prudently investing capital only in high return downstream projects. Hindalco Industries reported 17.7% increase in quarterly profit for Q3 FY18, aided by higher metal prices.

iv) Growing Economy acts as a Tailwind – Aluminium and copper have wide applications in industrial, construction and consumer goods products. There is a growing demand for these metals as the population increases. Demand for aluminium in the automotive industry continues to grow driven by light-weight materials in vehicles and electric vehicles being mandated by government regulations. Novelis also announced an investment of $300 million in an automotive aluminium sheet manufacturing facility in Kentucky to expand manufacturing for automotive purposes. Hindalco has an impressive pan-India presence and should benefit from the growing economy as well as increasing demand.

Source: Hindalco

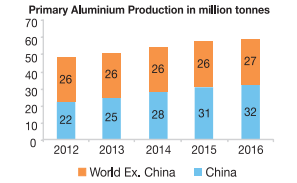

The global economy also continues to move upwards and is expected to grow at 3.9% in CY18. Demand growth in Rest of World is driven by automotive, building & construction and industrial sectors. Hindalco has also benefitted from a fundamental demand growth globally and shut down of Chinese production facilities.

Hindalco Key Risks

Oversupply in the domestic market and increasing input cost are key risks for Hindalco. There are concerns of low-cost aluminium and copper imports which is hurting the domestic players like Hindalco in India. China is the largest producer of aluminium in the world.

Source: Hindalco Presentation

Moreover, any weakness in global demand for aluminium will also adversely affect Hindalco’s operations. Global trade sentiment also plays a major role in determining the base metal prices.

High debt is another cause of concern for the company; however, Hindalco is pre-paying huge amounts to cut its high-cost debt balance.

An increasing awareness about renewable sources of energy like solar and wind could also adversely affect Hindalco’s operations as the majority of its plants run on thermal power. Though the company has plans to invest in solar parks, it might face pressure from the growing renewable energy trend going forward. China’s largest copper producer Jiangxi Copper Co. had to shut down its production facility after the local government order, as the country braces itself to adopt renewable energy more aggressively to fight climate change concerns.

Valuation

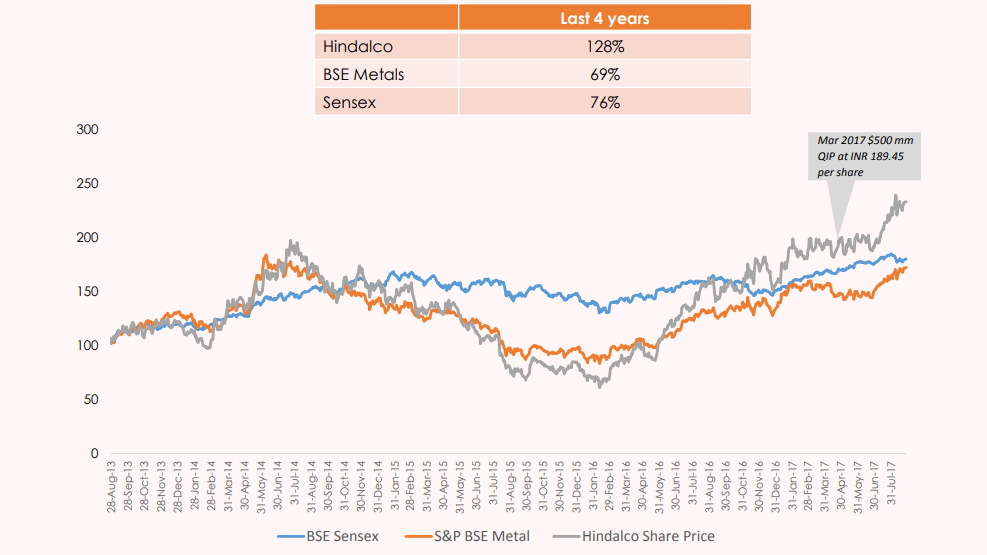

Hindalco is currently trading near INR 214 levels, 24% lower than its 52 week high. The company has a market capitalization value of INR 48,100 crore. Though Hindalco shares have fallen from INR 240 at the beginning of the year to INR 214 currently, the long-term prospects of the industry remain strong. Note the Nifty Metal Index has declined by over 9% so far in 2018. Over last four years, Hindalco’s return was higher than BSE Metal Index and Sensex as can be seen below.

Source: Hindalco Investor Presentation

Conclusion

Hindalco ranks among the global top five aluminium producers based on shipments. The company has come a long way from being an India-centric aluminium company in 1958 to a leading integrated producer and the world’s number one producer of aluminium flat-rolled products today. Hindalco has been around for the last six decades and is thus a supplier of choice for many worldwide. The company is focusing on downstream expansion in both Aluminium and Copper segments to take advantage of growth in India. It should also benefit from both global as well as domestic demand, given the current Chinese situation. I think it is a good time for investors to buy Hindalco shares and benefit from this trend.

share your thoughts

Only registered users can comment. Please register to the website.