Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINTata Steel (NSE:TATASTEEL) is the flagship company of Tata Group. Tata Steel is an Indian steel manufacturing company headquartered in Mumbai. The company has operations in 26 countries and have a commercial presence in over 50 countries with employees across five continents. Tata Steel has touched the lives of millions through the steel they produce. It is the world’s second-most geographically diversified steel producer. It is a fully integrated company having a presence right from mining to manufacturing and marketing of finished products. India’s GDP is projected to grow to $3.6 trillion by 2020, which augurs well for Tata Steel that focuses on domestic growth in the future.

Tata Steel Positives

i) A global enterprise with a reputed brand name - Tata Steel is Asia’s first integrated private steel company established in 1907. The company is a leading global steel company today having significant market positions in India and Europe with diversified product base targeting multiple end-user segments.

It is the lowest cost producer of steel in Asia and also amongst the lowest cost steel producers globally. The company has a reputed brand name highly revered by the Indians. It is India’s most valuable brand, with a brand value of $13bn by Brand Finance, UK 2017. Tata Group is the largest shareholder of Tata Steel with 31.35% stake in the company.

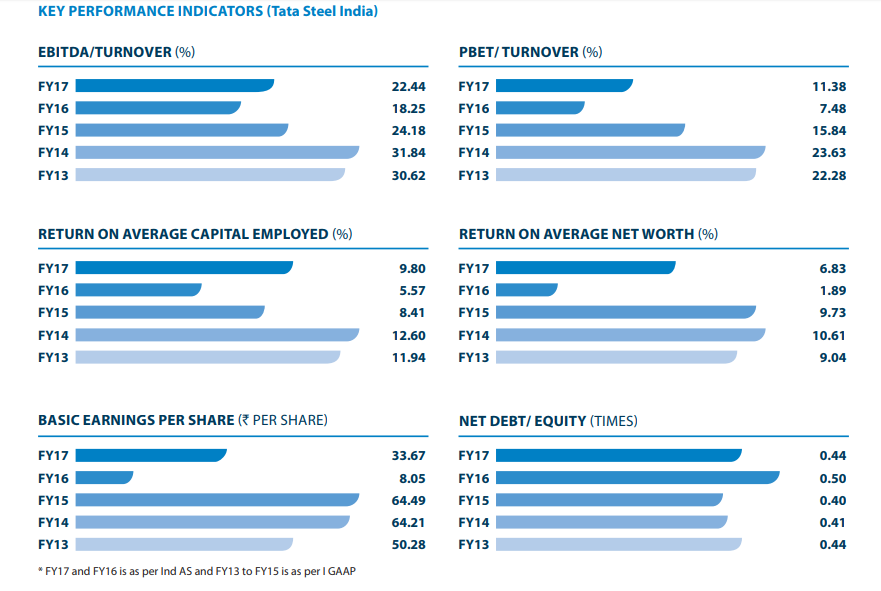

ii) Ramping Capacity and New Initiatives will increase productivity - Tata Steel has doubled its India capacity in the last decade. The company has a current crude steel production capacity of 27.5 MTPA. Access to low-cost raw materials and cost savings will further improve operating margins. Tata Steel has demonstrated improving metrics over the years as can be seen below. The company has identified 'Industry 4.0' as a strategic initiative to attain 'Smart Factory' status with enhanced productivity and sustainable performance. It is also adopting digital technology as one of its key priorities. Tata Steel is also investing in new technology like HIsarna in the Netherlands, a more flexible new smelting reduction technology to produce steel from lower grade raw materials.

Source: Tata Steel Annual Report

Tata Steel has also expressed interest in acquiring the distressed assets of Essar Steel, which operates a 10 MTPA facility in Gujarat. If successful, this acquisition will provide a good opportunity to expand Tata Steel’s reach to the western parts of India, since its major domestic production is situated in the eastern part of the country. The company is also looking at merging with Thyssenkrupp’s European steel business. This will result in the creation of Europe’s second-largest steelmaker after ArcelorMittal.

iii) A diversified portfolio of value-added products - Tata Steel is a global leader across several sectors like IT & communications, automotive, consumer products, materials, energy, chemicals, services. It is thus immune to economic fluctuations in businesses through its diversified product portfolio. Tata Steel accounts for 17.4% of total Tata Group’s revenue.

iv) Economic Growth in India acts as a tailwind - The company is in a good position to benefit from the global steel upcycle and economic growth momentum in India. India continues to remain one of the fastest growing major economies in the world. The Indian steel demand is expected to grow at 5.7% per annum in 2018. Passage of GST laws should further accelerate an increase in organized sector market share. Auto and capital goods sector continues to do well in India. However, the construction sector is witnessing soft demand currently. Tata Steel (22% in FY 17) has consistently outpaced the average industry growth (5%). Conditions are also improving globally. Global economic recovery is now more broad based and continues to strengthen with manufacturing also seeing an upturn.

Downsides

The steel industry is very sensitive to global events. Any changes in regulations impositions of duties/ laws can adversely affect the steel companies. Cheap import from neighboring nations like China, Korea, and Russia is also a cause of concern for Indian domestic steel manufacturers like Tata Steel. An economic downturn also dampens business as there is a slowdown in auto and construction industries.

Valuation

TATASTEEL is currently trading near INR 670 levels gaining almost 40% in the last year. Its market capitalization value is INR 74,366 crores and trades at a high P/E valuation of 39x. The company also pays dividends to its shareholders and has a dividend yield of 1.6%. The company has demonstrated a successful track record of raising capital at competitive terms and financial flexibility. The stock is currently trading 17% below its 52-week high and investors can look at buying on dips.

Source: Moneycontrol

Conclusion

India has both the raw material and a growing market for steel. Tata Steel is the largest steel manufacturing company in India and should also leverage from the fact that only domestically manufactured iron and steel products are preferred in government procurement. The recently announced National Steel Policy 2017, targets to increase steel manufacturing capacity to 236MT by FY’26 and 300MT by FY’31. India steel prices are expected to remain healthy in near term as the domestic market picks up. Tata Steel has an end-to-end value chain extending from mining to finished steel goods, serving a wide range of market segments. Its recent ramping up of capacity in Kalinganagar, critical restructuring initiatives and performance transformation programme in Europe should further lead towards a value-creating enterprise across the commodity cycle.

share your thoughts

Only registered users can comment. Please register to the website.