Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINAsian Paints Ltd. (NSE:ASIANPAINT) is the largest paint company in India, accounting for over 30% of the Indian market share. The company engages in the manufacturing, selling and distribution of paints, coatings, home décor and bath fittings products, and other related services. Asian Paints manufactures a wide range of paints for decorative and industrial use as well. Founded in 1942, the company has a large global presence with operations in 16 countries and serving people in over 65 countries worldwide. Increased consumer spending, government's infrastructural reforms, subsidized housing over the years have resulted in higher demand for paints.

Asian Paints’ Positives

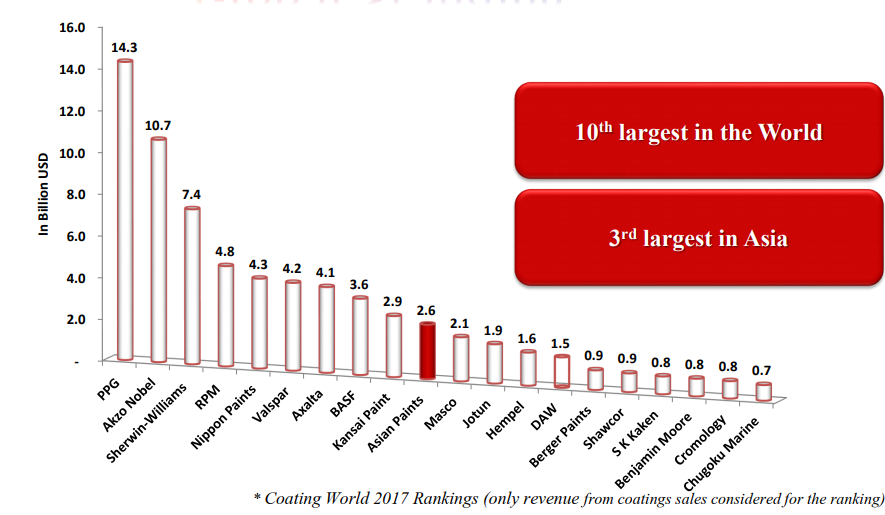

i) Large Global Footprint – Asian Paints is the third largest paint company in Asia and has manufacturing facilities in 25 countries in the world. The company has a presence in 15 countries spread over four regions. It is also the tenth largest coating company in the world. The group operates through its subsidiaries - Berger International, Apco Coatings, SCIB Paints, Taubmans and Kadisco around the world.

Source: Asian Paints Presentation

ii) Extensive Knowledge and R&D Base – With over 75 years of experience, Asian Paints has developed a rich and extensive knowledge base. It also runs many international research centers and a dedicated group R&D center in India. The company is also expanding its capacity and investment in IT tools to automate controls and minimize errors.

iii) Leading Brand Name and Impeccable Reputation – Asian Paints can benefit from its market leadership position in the decorative paints segment, which accounts for more than 75% of the total paint market in India. The company has come a long way from starting as a small partnership firm way back in 1942 to becoming the largest paint company in India. Asian Paints has been the market leader in paints since 1967, driven by its strong customer focus and innovation. As a result of this leadership position and a long industry experience, Asian Paints also enjoys sticky customer relationships.

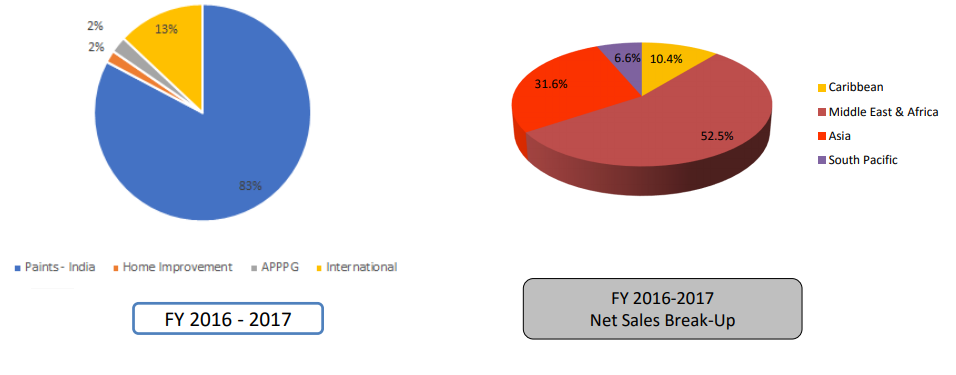

iv) Comprehensive Product Portfolio – Paints India is Asian Paints largest segment accounting for over 80% of the overall portfolio, followed by international (over 10%), Home Improvement (2%) and Asian Paints PPG (APPPG). Asian Paints manufactures a wide range of paints for decorative and industrial purposes.

In decorative paints which is the largest business unit of the company, Asian Paints is present in all the four segments - interior and exterior wall finishes, enamels and wood finishes. It also offers waterproofing, wall coverings, and adhesives. Through several acquisitions, Asian Paints today also has a presence in the home improvement segment.

In the Industrial segment, the company operates businesses for auto and non-auto industrial coatings.

Asian Paints has a strong presence in all product segments, servicing over 45,000 dealers.

Source: Asian Paints Presentation

v) Efficient Operations – Asian Paints owns world-class, large manufacturing facilities with latest automation technologies and operates strong distribution and logistics network across geographies. Vertical integration, efficient manufacturing, and logistics, smart retailing strategy are other key competitive advantages.

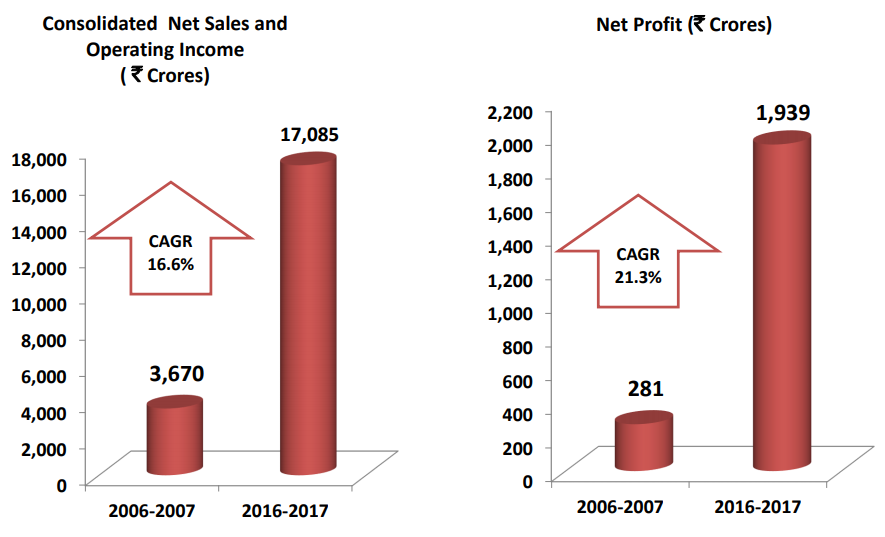

The company has been improving its net sales and profits numbers growing them respectively, by 16.6% and 21.3% CAGR over the latest decade.

The company posted 16% rise in Q3 net profit and almost 11% growth in revenues y/y, though volume growth was disappointing. Though higher input cost adversely affected gross margins, Asian Paints was able to deliver improved operating margin due to its cost-saving efforts (cutting advertising spending majorly). Asian Paints is also focusing on its core product portfolio and is exiting its chemical business slowly, as its contribution to the total revenue has been continuously decreasing.

Source: Asian Paints Presentation

Key Risks

a) Raw Material Cost – Price of the raw material determine the profitability of the paint company to a large extent. Titanium dioxide, phthalic anhydride, and peutarithrithol constitute around 50% of the total cost. Most of the raw materials are petroleum based derivatives. Hence any fluctuation in crude oil prices leads to change in the prices of raw materials. Asian Paints’ recent quarter’s input costs rose by nearly 14% y/y.

b) Other Risks - Asian Paints is a consumer discretionary goods company, which means its sales depend upon the availability of extra funds in the hands of customers. In times when inflation is on the rise, customers tend to curb their discretionary spending, which adversely impacts sales. Moreover, its business is also cyclical in nature. Policy formulations like GST implementation and demonetization also caused disruption. Being a global company the company is also exposed to currency fluctuation.

Valuation

Asian Paints has a market capitalization value of INR 107,962 crore which is higher than Kansai Nerolac Paints’ (NSE:KANSAINER) value of INR 26,600 crore. Asian Paints’ stock is currently trading at a P/E of 51x, near INR 1125 levels which is 12% lower than its 52-week high. The company also pays dividend consistently and has a reasonable payout ratio of near 50%. Though the recent stock performance has not been very exciting for investors, Asian Paints has returned almost 7000% (2000-Aug 2017) which is mind-boggling.

Source: Money Control

Conclusion

The Indian paint industry has returned 10,000% during the last 17 years, outperforming Sensex and Nifty. According to IPA (Indian Paint Association), the paint market is expected to cross INR 70,000 crore by 2019-20 from INR 40,000 crore in 2014-15. The Indian economy has been supportive of the overall paint industry. Asian Paints is the clear leader in Indian paint industry commanding 30% of the overall market share, followed by Kansai Nerolac Paints (market share of 11%), while the unorganized sector constitutes 35% of the total market. Given, Asian Paints leadership positions both in domestic and international markets, strong pace of urbanization and rising incomes, the company should continue to paint colourful stories in future.

share your thoughts

Only registered users can comment. Please register to the website.