Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

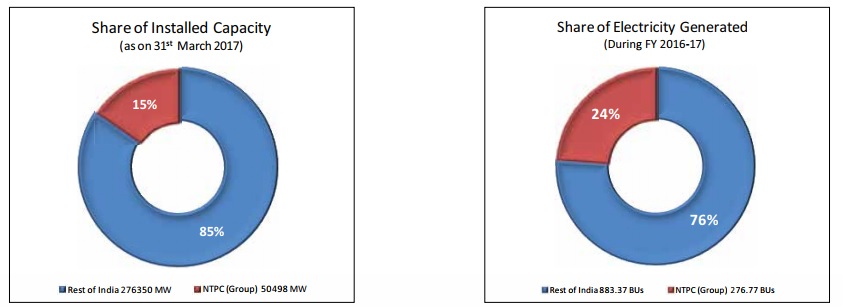

Established in 1975, National Thermal Power Corp or NTPC (NSE:NTPC), as it is popularly called, is India’s biggest power utility. The company claims to light up every fourth bulb in the country. It has the largest power generation capacity in the country and became a Maharatna company in May 2010. Presently, the Government of India owns 70% of NTPC while the rest is owned by institutional investors, banks and public. The company is also playing an instrumental role in helping India get closer to achieving its 175 GW of renewable energy target.

Let us analyze the company in a little detail to assess investing in its shares.

Image Credit: NTPC

NTPC Positives

i) Diversified Asset Base - NTPC is India’s largest power utility with an installed capacity of 51.7 GW. The company is an integrated power major and has a presence in the entire value chain of the power generation business. Its portfolio consists of hydro, gas and renewable energy assets. NTPC owns 20 coal, 7 gas, 1 hydro and 1 wind based station. The company is focusing its energies towards developing non fossil fuel based generation capacity and expects it to constitute nearly 30% of its portfolio going forward.

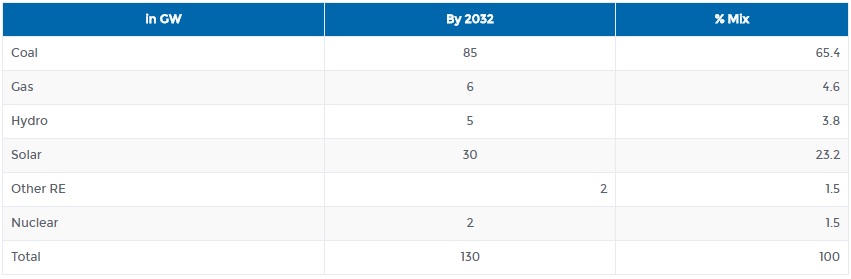

ii) Growing and Strong Pipeline - NTPC plans to increase its power capacity to 130 GW by 2032. The company has earlier planned most of the expansion to come from coal-based thermal power. But given the reluctance of financial institutions to fund fossil fuel power and the increased competitiveness of renewable energy particularly solar energy, the company has increased the mix of solar energy and reduced thermal power generation. NTPC has also adopted a multi-prong strategy which includes greenfield projects, brownfield projects, joint ventures and acquisition of existing plants route. This is a good move by the company in keeping up with the times.

Currently, the company has 20 GW of capacity under construction and is committed to delivering these projects in time.

iii) Dependable Management Team and Attractive Financials – NTPC has an exemplary record in execution and good management as well. Unlike other state-owned firms, NTPC is generally seen as an efficient organization. Its rock solid balance sheet also enables NTPC to win good prices for its tenders as people ascribe low risk to NTPC as compared to the other state-owned organizations.

NTPC is profitable and a relatively well-run power producer that produce good profits and manages to operate efficiently. The company is known for its solid balance sheet and long profitable history.

NTPC also successfully achieved INR 8,000 crore in savings for the state, reducing per unit cost by 40 paise in FY 16-17 by swapping and rationalization of coal and reducing imported coal consumption by 85%. The company successfully reduced its cost of debt by domestic loan restructuring. The company is also recording an improvement in its plant load factor (PLF) and plant availability factor (PAF) signifying improved demand and better fuel availability. It also pays regular dividends to its shareholders.

iv) Diversified Businesses – In today’s world of rapid change, it is good to put your eggs in different baskets. NTPC has diversified into consultancy, power trading, rural electrification, coal mining, energy storage and Electric vehicles. NTPC is also targeting a market share of 25% in ancillary services and storage.

Source: NTPC Annual Report

Key Risks

NTPC is predominantly a thermal power utility. Coal occupies a major share of NTPC’s portfolio today and will continue as predominant fuel with 65% share of the portfolio even by 2032. Coal is facing acute pressure from falling solar prices in India. The country has already abandoned building almost 14 GW of coal-fired power stations.

Though NTPC is diversifying into renewable energy the pace of change is slow. New technologies such as blockchain, energy storage, and others threaten to disrupt the model of the existing power sector with many people going off the grid in the future. This will threaten NTPC’s long-term PPAs with distribution utilities who may see declining demand in the future.

While large-scale solar energy is providing a growth path for NTPC, this may not remain so as solar energy becomes increasingly decentralized. Coupled with storage, solar energy on rooftop solar might become more viable leaving NTPC with fewer alternative options.

Valuation

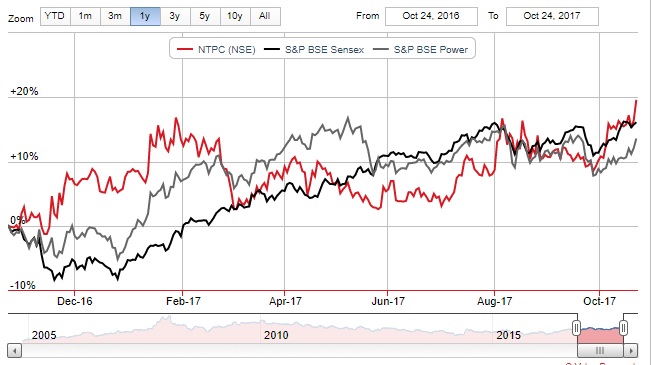

NTPC is currently trading near the INR 180 mark and has returned close to 20% in the last year. The stock performed better than the broader S&P index and power sector as can be seen below. The stock looks reasonable with a P/B of 1.5x. The company has a market capitalization value of INR 150,153 crore.

Source: Value Research Online

Conclusion

NTPC is a dominant power player with a presence across the entire power generation value chain. It is also one of the key firms that have been identified by the government to meet India’s ambitious 175 GW renewable energy target. The company plans to become a 130 GW power company by 2032 and is smartly diversifying into solar, wind, hydro and other renewable energy sources. Given the government of India’s backing and reasonable valuation, I think it is a good way to play the Indian power sector.

share your thoughts

Only registered users can comment. Please register to the website.