Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIndia is like a safe haven for investment when compared to other global economies. Foreign investors are increasingly investing in Indian ETFs to grab the opportunity. The Indian economy appears to be a bright spot in the global economy, given a large number of economic reforms and a strong government at the Centre. The Indian banks have thus a massive opportunity at hand to leverage from this growth. Yes Bank (NSE:YESBANK) is the fifth largest (by assets) private sector bank in India, with over 1,000 branches and a 1,800 ATM network. Founded in 2004, the company has established itself as a renowned brand amongst a large number of established banks. The bank has continued giving good shareholder returns and better operational efficiencies. I believe Yes Bank is a good way to play the Indian financial growth story.

Let’s take a closer look at Yes Bank.

Yes Bank Positives

i) Extensive Branch Network & Digital Services

The bank has an extensive branch banking network and is also looking at expanding its presence across major cities and towns in the country. In addition, Yes Bank provides a wide range of services like corporate & investment banking, financial markets, corporate finance, business and transaction banking, and wealth management and a range of comprehensive products and services to its corporate and retail customers.

Yes Bank is regularly investing in developing a strong digital portfolio of products. The country is witnessing a major banking and payment transformation through increased penetration of digital payment systems such as Unified Payment Interface (UPI), Bharat QR and BHIM app. Yes Bank holds 38% market share in the UPI ecosystem. It also has a strong presence in social media.

ii) Good Growth in the Recent Past

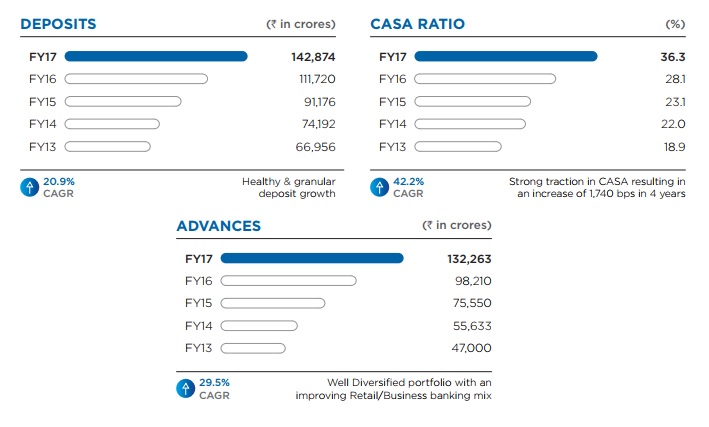

The company has been growing healthily in the past years as can be seen from the image below. Yes Bank has shown an improvement in its operational performance. The bank reported 32% rise in net profit at more than INR 900 crore for the first quarter of FY18. The bank’s advances and deposits have also grown by 32% and 23%, respectively y/y in the latest quarter ending June. Its CASA ratio sits at a healthy 36%, driven by growth in its current account balance. The bank is rapidly gaining market share and its growth has been pretty decent when compared to its peers.

Source: Yes Bank

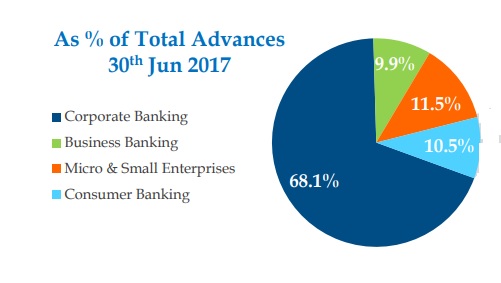

Yes Bank has been shifting to a more retail focus. It is ramping up branches across the country to build up retail assets. Its corporate portfolio (largely secured portfolio - SME and mid corporates) also continues to be well rated with over 75% portfolio rated ‘A’ or better. Electricity, retail, and EPC industries are the largest sectors with major deployments.

Source: Yes Bank Investor Presentation

The company has a vision of “building the finest quality bank of the world in India by 2025”.

iii) Improvement in the Overall Indian economic system

The overall Indian macroeconomic position has strengthened with policy support over the last couple of years, providing structural strength and imparting efficiency to the Indian banking system. Several institutional reforms like implementation of the Insolvency and Bankruptcy Code, the creation of Monetary Policy Committee, the passage of GST, and the establishment of a less-cash centric economy were undertaken in India. Given the fact that the financial sector generally grows at a faster pace than a country’s GDP, investors can look at buying Yes Bank shares on dips.

iv) Pioneer of several Intelligent Products in India

Yes Bank may be the fifth largest bank in India, but this young bank can be credit with the introduction of the concept of Green infrastructure bonds and Vendor Financing solution using the Blockchain technology in India. The company raised more than $50 million through green bonds recently. The VFS using blockchain is capable of reducing the processing time for supply chain finance from four days to almost real-time. All these products will play a revolutionary role in the Indian banking system.

Yes Bank Challenges

Rising NPA levels

One of the major concerns of the Indian banks is the rising level of non-performing assets. The Reserve Bank of India has passed several resolutions in the past to ease the problem. The government has made a budgetary provision of pumping in about INR 75,000 crore into state-run banks for the four-year period ending March 2019. Though the problem is acute in case of public banks, several private sector banks are also facing huge NPA crisis. Yes Bank’s gross NPA was around INR 1,300 crores for the quarter ending June. Though the gross NPA ratio (0.97%) has declined from 1.52% a quarter earlier, it has increased from last year’s 0.79%. It is worth mentioning here that Yes Bank has low exposure to bad loans when compared to the other firms. The bank also recovered ~60% from one extraordinary account classified as NPA in Q4 FY17. The situation could improve with further expected recoveries.

Valuation

Shares of Yes Bank are currently trading near INR 1,700 level. The bank has a market capitalization of INR 78,600 crores. Its PB stands at 3.5x, compared to HDFC Bank’s (NSE:HDFCBANK) 4.6x. Yes Bank’s book value is the highest at ~INR 480, when compared to both ICICI Bank (NSE:ICICIBANK) and HDFC bank. The stock has returned more than 50% in the last nine months and the stock performance over last five years has been better than its top peers.

Source: Money Control

Conclusion

Implementation of structural reforms like Goods & Services Tax in India and JAM will enable India to remain one of the fastest growing large economies in the world. Top private banks in India are well positioned to benefit from the Indian growth story. Yes Bank has sustained growth of advances and deposits while maintaining best in class asset quality. The bank has been delivering consistent shareholder returns too and has shown consistent performance over the past years. The bank looks promising given its operational improvement and an increased retail focus. I would suggest investors buy the stock on dips.

share your thoughts

Only registered users can comment. Please register to the website.