Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINTech Mahindra (NSE:TECHM) is one of the largest Information Technology companies in India. It is a part of the Mahindra group which is amongst the largest business conglomerates in India. Starting out as a joint venture with British Telecom, Tech Mahindra began operations as Mahindra-British Telecom (name changed to Tech Mahindra in 20016) in the year 1986. Today, the company operates in various sectors such as telecom and enterprise solutions and provides a host of computer programming, consultancy and related services in over 90 countries.

The company, like the other IT giants in India, is facing headwinds ranging from automation to protectionist policies being adopted in the USA. Tech Mahindra is also facing heightened competition from other leading IT firms in the country and abroad. Times are challenging for these companies and it remains to be seen if Tech Mahindra can successfully come out of this difficult phase.

Tech Mahindra Headwinds

i) Difficulties in their Biggest Market

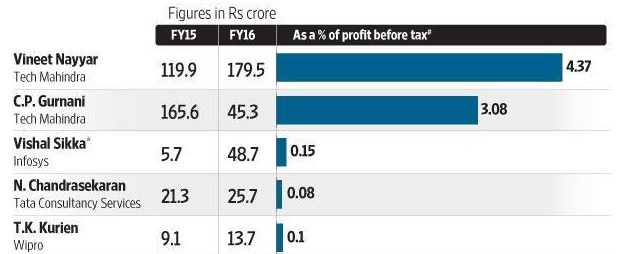

Almost 50% of Tech Mahindra’s revenues come from the USA, followed by Europe (30%) and rest of the world (~20%). Tech Mahindra is suffering from a strengthening of the Indian rupee and headwinds from Trump’s tightening of H1B visa regulations. The company reported operating margins at 12% in the fourth quarter, the lowest among the top-five Indian software exporters. The company is resorting to measures like firing the Indian staff and hiring U.S citizens in order to face the challenge. Tech Mahindra is also facing criticism for high executive salaries. The conditions are so dismal that twenty of its top executives have offered to take a pay cut of 10%-20%.

Source: Livemint

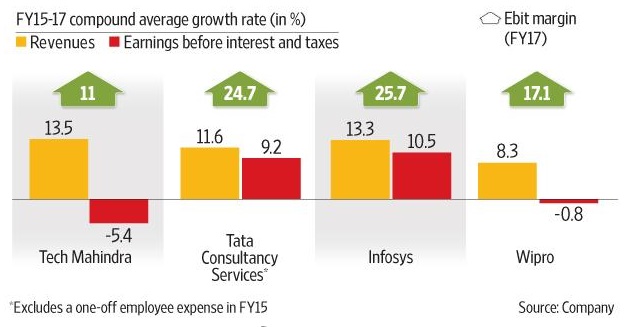

ii) Competition is taking a toll – Tech Mahindra is the fifth largest IT company in India by revenues. The company competes with the likes of Infosys, Tata Consultancy Services, HCL Technologies, Wipro and many other international IT companies as well. Though Tech Mahindra is evolving, with its DAVID (digital, automation, verticalization, innovation and disruption) strategy, the company is facing immense competition not only from its traditional competitors like Infosys and Wipro but also from technology giants like Amazon.com who are expanding their web services and cloud offerings. Tech Mahindra’s performance has been the weakest when compared to its peers over the last two years.

"The industry is in the midst of a necessary yet painful transition. We are trying to address a new decision-maker, learn to speak to customers in a new language and address their problems in new ways," says Jagdish Mitra, of Tech Mahindra.

iii) Overall prospects of Indian IT firms is faltering – The Indian IT companies are being hurt by higher visa fees, stronger rupee and uncertainty around protectionist measures in the USA. All these will raise the operational cost for the Indian firms. Nasscom (National Association of Software and Services Companies) estimates software export growth between 7% and 8% (in constant currency), in fiscal 2017-18 declining from 8.6% in the last year. There has been a shift in the way of doing business from the traditional outsourced, cost-based software services to artificial intelligence based services Increasing automation and cloud computing have hit jobs which were earlier handled by entry-level professionals.

Tech Mahindra Positives

a) Good Recent Quarter Performance – For its quarter ending 30 June, Tech Mahindra reported a 6.5% increase in net profit. Revenues also grew by 6%. The company’s net profit was up by more than 11% in dollar terms. The recent quarterly performance was better than expected during the seasonally weak quarter.

b) New Initiatives – CEO CP Gurnani says his priority is to stay relevant in the changing times. Cybersecurity, imaging as a service, blockchain, Internet of things and network services are the company’s five big bets, which could take another 6-10 months to go into production phase. The company claims that about 65% of the business which comes from traditional IT will change to 50% by 2020.

Valuation

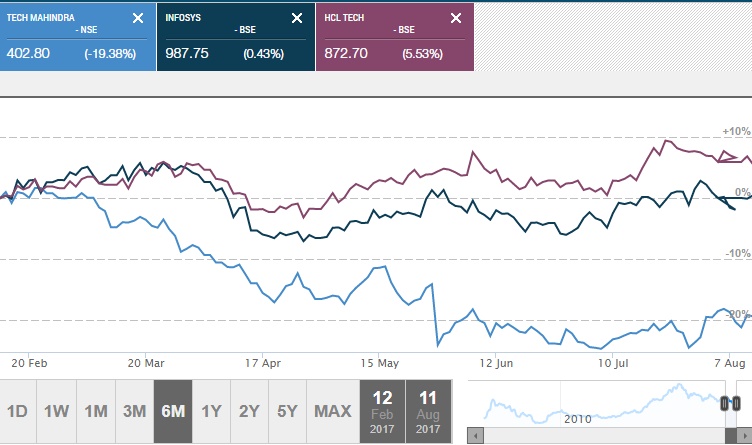

Tech Mahindra’s stock is trading at 13.7x P/E. The valuation seems reasonable when compared to the industry average of 18.5x. Trading currently near the INR 400 levels, Tech Mahindra has a market capitalization value of INR 39,305 crores. However, the stock performance has been dismal losing more than 19% in the last six months. The decline has been quite steep when compared to its peer Infosys and others as can be seen below.

Source: Moneycontrol

Conclusion

The $150 billion Indian IT industry accounts for about 7% of the Indian GDP. India is a good source of quality and low cost labour resources. Though there is no other better alternative to India, the pace of growth will not be as fast as in the past. If the Indian IT companies do not modify their traditional ways they might start losing market share to other global peers. Though most of the challenges faced by Tech Mahindra holds universally true for the Indian IT industry at the moment, the company’s performance has been the weakest amongst its peers. The company is trying hard to revive through cost cutting and new innovations but results are still to be seen. I think it is time for investors to revisit their portfolio and remain on the side lines till there is some clarity around the industry growth. They may look at better IT options like Infosys, which is leading the race not only in the USA but also in India after winning the contract for building GST (Goods and Services Tax) technology network across the country.

share your thoughts

Only registered users can comment. Please register to the website.