Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINThe Indian pharmaceuticals market has grown at a CAGR of more than 17% over the last decade. The country has become the largest provider of generic medicines globally and is also expected to expand going forward. The main reason why the country has prospered is due to its low cost of production which gives a competitive edge over the other countries. Sun Pharmaceutical Industries Ltd. (NSE:SUNPHARMA) is the largest drug maker in India commanding 8.5% of the Indian drug industry. It owns 19 brands out of India’s top 300 pharmaceutical brands. The company engages in the manufacturing and promotion of branded generic pharmaceutical products. Sun Pharma has over 2,000 marketed products and serves more than 150 markets worldwide. The company is the fourth largest specialty generic pharmaceutical company in the world. Currently, the company is facing immense pressure from declining sales in the U.S. and increased USFDA regulations. Will sun Pharma make it or break it? Let us analyze the company from an investment perspective.

Sun Pharma Positives

i) Strong Product Portfolio & Pipeline – Sun Pharma has an industry leading product portfolio with a variety of generic and specialty products across CNS disorders, Cardiology, Diabetes and Metabolic disorders, Gastroenterology, Ophthalmology, Oncology, Pain, Allergy, Asthma and Inflammation and Gynaecology therapies. The company has a robust pipeline of 149 ANDAs, including high-value First-to-File opportunities. Sun Pharma has a track record of successful product launches.

ii) Large geographical presence – Sun Pharma has a diversified global footprint having a presence in leading markets like the U.S., Europe, and key high-growth emerging markets like Russia, Romania, South Africa, Brazil, and Malaysia. As the largest drug maker in India, Sun Pharma should benefit from the attractive new product launch opportunities in India, low pricing pressure, limited competition and bargaining power. Moreover, the government of India is currently focusing on lowering healthcare costs which will further benefit large Indian companies like Sun Pharma.

iii) Trusted Brand name – Sun Pharma is known for its high-quality, affordable medicines trusted by healthcare professionals and patients worldwide. It has around 2000 research scientists working in multiple R&D centers. Sun Pharma was one of the pioneers among Indian pharmaceutical companies to understand the significance of research and development, starting three decades ago. Its early mover advantage in R&D investment made it a key differentiator and developer of a wide range of robust products for global diverse markets.

iv) Improving Financial Metrics over the years – Sun Pharma has shown improving financial performance over the past years as can be seen from the image below. Though the company is facing headwinds in its U.S market, its domestic sales grew by more than 5% during the last financial year.

Source: Sun Pharma

iv) Positive impact of GST – Goods and Service Tax or GST is one of the biggest tax reforms in India. Though sales in the first quarter of most pharma companies might be negatively impacted as they had to adjust their inventories, GST would be beneficial in the long term as it simplifies the taxation process in India. The GST bill is expected to boost the local manufacturing sector, make the supply chain more efficient, reduce the cost of medical treatment, lower prices on essential, life-saving drugs and custom duty on imported medical equipment.

v) Expanding Inorganically – Though Sun Pharma has an impressive product portfolio, it is also expanding inorganically through acquisitions. Recently, the company entered into a $175 million-agreement with Switzerland-based Novartis AG, to acquire its cancer drug Odomzo. Sun Pharma also plans to acquire an 85% stake in Russia’s Biosintez for expanding its footprint in Russia. Furthermore, Sun Pharma in agreement with Japan's Mitsubishi Tanabe Pharma Corporation will also market its 14 prescription brands in Japan. All these efforts further solidify the company’s stance in becoming a leading international pharmaceutical company.

Sun Pharma’s Weakness

Increasing Competition in the U.S. market – Sun Pharma derives ~40% of its total revenues from the U.S. markets. However, the company has recently come under pressure in the foreign market which is impacting its profits adversely. The generic industry in the U.S. is rapidly changing. Moreover, the US Food and Drug Administration (USFDA) has also sped up the process of product approval which has resulted in higher number of generic drugs now available at reasonable prices. As a result, competition has increased and Sun Pharma reported a 6.8% decline in quarterly sales in its most recent Q4 results.

“US generic industry is facing rapidly changing market dynamics,” said Shanghvi.

For the first time, Sun Pharmaceutical Industries Ltd expects a single-digit revenue decline this fiscal year.

Sun Pharma faces increased local competition from the likes of Dr. Reddy’s Laboratories, Lupin Ltd, Cipla, Glenmark Pharmaceuticals, Cadila Healthcare Ltd, Aurobindo Pharma Ltd, and Biocon Ltd in India. These companies are now focusing their research and development around specialty drugs. These companies are also working on increasing compliance to meet US FDA standards.

Valuation

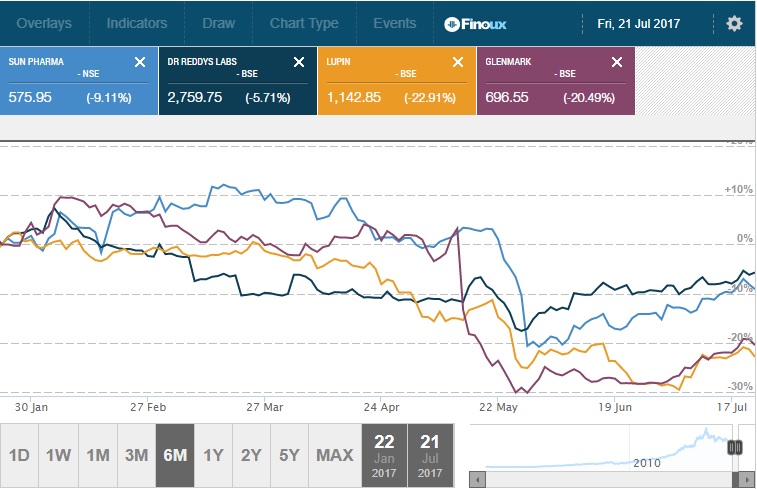

As a result of a slump in sales, Sun Pharma has lost more than 9% in the last six months currently trading near INR 588 level. Its market capitalization value has almost halved to INR 141,139 crore. The stock is currently trading at almost 18 times its earnings, which does not look very expensive. The stock price has in fact corrected itself driven by the USFDA onslaught and has given better returns than most of its peers. The stock is down by more than 20% since the last year and I think it is a good time to invest.

Source: Money Control

Conclusion

India is the largest producer for generics and the healthcare sector is expected to double to almost $150 billion by 2017, from 2012 levels. The Indian pharmaceutical market is worth INR 1,13,739 crore for the year ending June 2016. Sun Pharma is one of the largest pharmaceutical company in India and also has a growing global footprint. It stands in a good position to benefit from the rising number of old and ailing population. Though the company has recently come under pressure in its leading U.S. market, it is concentrating on developing a differentiated portfolio of specialty drugs to combat rising competition. The company’s financial strength also ensures appropriate investments in products. The company should continue meeting compliance standards and its focus on R&D to stand out from the crowd. With the recent stock price correction, I think it is a good time to build a position in India’s pharmaceutical giant.

share your thoughts

Only registered users can comment. Please register to the website.