Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINThe Goods and Services Tax or GST was implemented amidst shareholder anticipations but has been taken positively by the markets. However, what was earlier thought of as a boon turned into a disadvantage for ITC (NSE:ITC). The company's shares were up by more than 5%, post-GST implementation but given the recent imposition of additional cess on cigarettes, ITC shares slumped by more than 12%

ITC is one of India’s leading conglomerates with many diversified businesses under its umbrella. The company engages into FMCG, hotels, paperboards & packaging, Agri business & Information Technology. Formed in 1910, as Imperial Tobacco Company of India Limited, ITC diversified into non-tobacco businesses in the 1970s. The company exports to 90 countries and remains amongst the top 3 contributors to the exchequer. ITC has four cigarette production facilities in India. The company along with Godfrey Phillips India Ltd (GPI) are the leading manufacturers of cigarettes in India, with ITC alone accounting for a retail volume share of 79% and GPI at 11%.

Competencies, enterprise strengths and strong synergies between its businesses are ITC’s core competitive strengths. Let us take a closer look at the company and its prospects amidst increasing cigarette prices.

ITC Positives

i) Diversified Products & Businesses

ITC is a leading business group in India having a successful portfolio of 13 businesses. Cigarette business is its core business with cigarette revenues being the largest contributor to the company. Though cigarette business is still the largest revenue generator for the company, ITC is reducing its dependence on the cigarettes business.

The company has a strong line of food items diversified across staples, snack foods, ready-to-eat foods, juices, dairy product and confectionery. Its major food brands include Kitchens of India, Aashirvaad, Mint-o, gum-o, B natural, Sunfeast, Candyman, Bingo! and Yippee! The company owns leading personal care products sold under Fiama Di Wills, Vivel, Essenza Di Wills brand names. Wills Lifestyle and John Players brands are leading apparel brands in India. ITC also has other business like hotels, paper packaging and IT. The diversified line of businesses safeguards the company from volatility in any one sector.

Source: ITC Corporate Presentation

ii) Leading Cigarette Manufacturer in India

ITC sells more than 80% of cigarettes in India. India’s tobacco market is estimated at around $11 billion. The country has become a huge market for cigarettes with India alone accounting for more than 12% of the world’s smoking population. Some of ITC’s popular brands of cigarettes sold in India are Insignia, India Kings, Lucky Strike, Classic, Gold Flake, Navy Cut, Players, Scissors, Capstan, Berkeley, Bristol, Flake, Silk Cut, Duke & Royal. ITC’s portfolio of cigarettes is known for its quality, environmental management systems, and product excellence. Its Gold Flake tobacco brand is the largest FMCG brand in India.

iii) Leading Player in many of the markets it serves

ITC not only owns a portfolio of rapidly growing businesses but is also the clear market leader in most of the market segments its serves. It is the leading FMCG company in India and the largest seller of branded foods. According to a study conducted by the Boston Consulting Group, ITC is one of largest sustainable value creator in the global consumer goods industry.

iv) Strong Brand Name & Competitiveness

With a century long existence, ITC has developed a strong brand name synonymous with trust, value and confidence in its products. ITC has been listed among India's Most Valuable Companies by Business Today magazine and also ranks amongst India's '10 Most Valuable Brands'.

v) Impressive Performance Over the Years

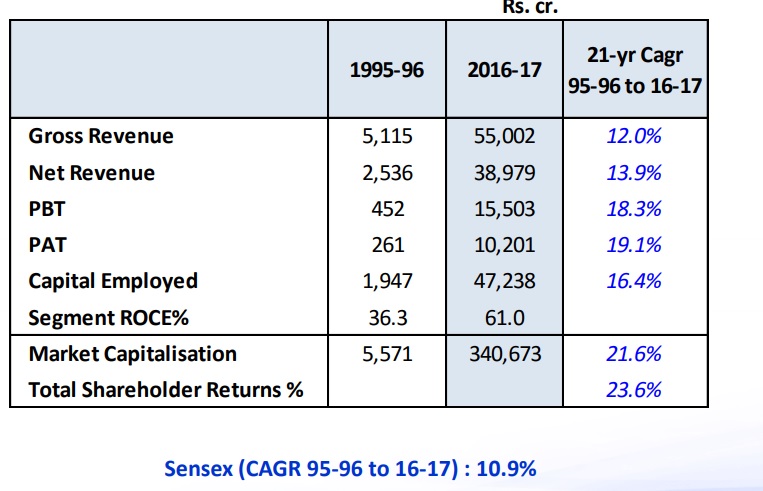

Source: ITC Corporate Presentation

ITC Weaknesses

Pricing Pressures in Its Core Business

The government of India has made it mandatory for companies to display 85% pictorial warnings on cigarette packets and completely banned smoking in public places. The industry continually faces increased regulatory and taxation pressures which have led to a significant fall in sales of retail cigarettes volume by 8% to 88.1 billion sticks in 2015. The excise duties and VAT on cigarettes considerably went up in the recent years. As such ITC’s ‘64mm category’ of cigarettes face immense competition from illegal manufacturers who have captured more than 20% in this segment.

The company was enjoying some breather in the form of the recent passage of the historical GST bill, wherein cigarettes were taxed at a lower rate for the first fifteen days. However, the council raised cess on cigarettes last week now taxing them at an effective rate of 10%-11%. ITC retorted by hiking cigarette prices by 6%-7% across all cigarette categories. While the rate hike might affect the company's performance in the short term, the demand for cigarettes will keep driving profits for ITC in the future.

Valuation

As an aftermath, ITC stock is currently trading near INR 288 levels. The stock was rallying this year until the recent blow (in the form of increased cess on cigarettes) which came in last week. The stock has returned more than 14% in one year. The company’s market capitalization value currently stands at INR 353,931 crores making it one of India’s most valued companies by market capitalization value (the company lost nearly Rs 50,000 crore in market capitalization in the last week). ITC also has a good dividend track record and has been consistently paying dividends to its shareholders. I think the recent fall in teh share price offers a good entry point for investors having a long term outlook.

Source: Money Control

Conclusion

ITC has transformed itself into a multi-business enterprise with diversified businesses. It has created some of the world-class Indian brands. It is also one of the largest employers in the nation creating six million sustainable livelihoods. ITC’s e-Choupal initiative alone has empowered four million Indian farmers in 35,000 villages across ten states. ITC is investing in India’s future by building world-class assets that are expected to enhance the country’s competitive capacity.

Though the company's short-term performance might be affected by the recent cigarette rate hike, ITC is a leading FMCG company in India with strong brand recon and leading market shares. It is also a good time for leading Indian blue chip stocks like ITC, as global investors are increasingly looking towards promising emerging market stocks amidst falling US yields. The Sensex is making new highs and the shareholders are cheering. ITC ticks all the boxes and definitely deserves to be in one’s portfolio.

share your thoughts

Only registered users can comment. Please register to the website.