Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

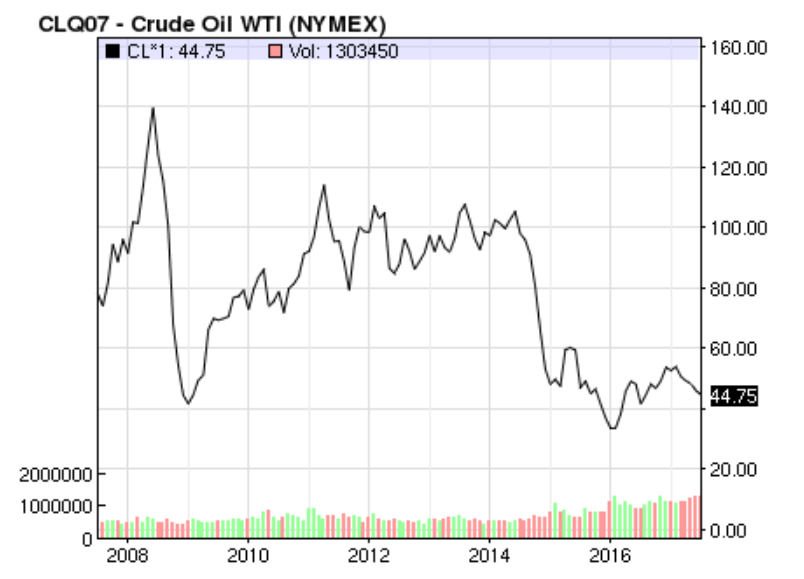

REGISTER NOW OR LOGINTechnically, the commodity in its current price structure has entered a bearish phase by making higher highs and higher lows on the daily charts which is making the crude oil look bearish from a short term perspective.

Crude oil at one point of time was trading at $ 140/ barrel which was raining money for the Middle Eastern countries and poor African nations. If estimates are to be believed then on an average 85-90% of the export income of OPEC nations comes from crude oil exporting. Oversupply concerns led by Saudi Arabia jolted the oil market made the price plummet to lower levels of $26/ barrel, the repercussions of which could be seen in the whole OPEC cartel. Countries like Venezuela who solely depended upon their oil revenue exports were seeing their foreign reserves drying up which made them crippled and were unable to pay for their imports as a result of which inflation soared to 1000% and havoc was created in the Venezuelan economy people were standing in queues for 5-6 hours for buying essential commodities for their houses. Political unrest began to surface on the streets and people were starving. This was only one nation which suffered the burnt of Saudi Arabia’s mistake.

Saudi Arabia lately realized that the oil pumping strategy won’t work in the long run as this cartel’s major objective was to give price stability to the crude oil. So, now it reversed its strategy and started producing less as compared to its previous output which led to further rise in price moreover it had made 10 countries signed a production cut agreement which had given some reason to cheer the crude oil price and in order to stabilize the price in the long-run they forced Non-OPEC countries (like Russian, Canada, Norway, etc) to sign the production cut agreement which further led to optimism for price.

Although a production cut agreement is already into action but no one actually knows that who is complying with the agreement and who is not?. In the past also such agreements were being signed by OPEC cartel but it never materialized because one may only compel to sign the agreement but not stop it from producing it or storing it, data sometimes can be manipulative. After analyzing certain facts on the ground came to the conclusion that now it is most likely that crude oil might not have a bounce back again and it is likely that a new low might form for the crude oil.

Analyzing it one by one would help the readers better understand that why it is difficult to think that crude will not bounce back:

This country has been not only keeping its market share protected from other countries but also eyeing others market share. Countries like Saudi Arabia have very low cost of producing crude oil so even crude comes down to $20 this country would still be minting money but others will not. This fact is pretty clear in the mind of Saudi Arabia so it pumped oil which led to the fall in price. So what happened suddenly that Saudi reversed its strategy of producing less oil?. The answer is simple in the year 2018 Saudi Aramco is to arrive and speculations are there that it is going to be one of the largest IPO in the history bigger than Ali Baba since it is an oil exploration company so valuations need to be higher only if the crude oil price is higher. Saudi from that very moment started cutting its production of crude oil so that Aramco’s valuation would go higher. The moment Aramco’s IPO would come they will again start pumping oil in the market.

After the production cut agreement was being signed OPEC members mutually decided that the above mentioned three countries would be exempted from the said production cut agreement. These countries have also a low BEP and their average operating capacity is round about 80%. These countries have reasons to be exempted from the production cut agreement. Libya after the ousting of Muammar Gaddafi had been a war zone constantly attacked by NATO forces and American forces. Libya’s operational cost for producing crude comes around 9-10$ per barrel and recent data shows that the production has increased from 700000 bpd to 885000 bpd which is big worry for the OPEC pact and moreover and being a country where maximum amount of revenue comes from exporting oil they would try and supply crude to maximum amount of developing countries.

Iran on the other hand was suffering from economic sanctions at the helm of America. On November 2016 the sanctions imposed were removed from Iran and it being the second largest producer of crude after Saudi would dump the market with heavy supplies of crude which would put further pressure on Crude oil price.

Nigeria is going through political turmoil as in the past all the oil revenue were not being used for the development of the citizens of Nigeria rather then it went into the pockets of Nigerian officials which led to political unrest in the country. The country’s current oil production is around 1.38 mbpd. An impediment is that the main oil producing region which is the Niger delta is still under the control of some terrorist organization and for which there are still talks going on if they end on a positive note than production and export of crude will start. Nigerian crude is one of the best crude among the OPEC countries crude.

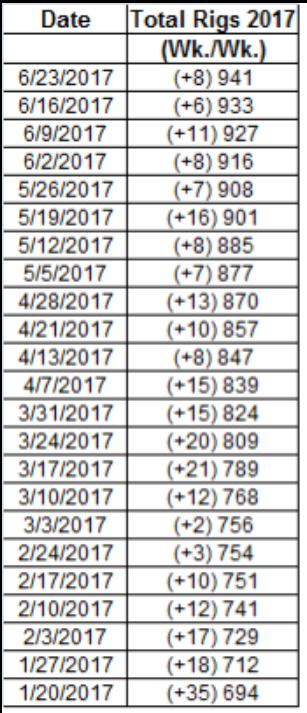

US is one big threat to the OPEC production cut agreement. The country has been continuously producing crude through its largest producing well in Permian Basin, Eagle Ford and Niobrara. The data reported by EIA shows that US drillers have added rigs for the straight 22nd week in a row which means that they are preparing for further expansion in the crude oil production. The increase in US drilling activity can be a big reason to worry for OPEC because they would in the future try and capture the OPEC’s market share which has started to show on grounds as China has started to import crude from US.

Moreover, one of the reason why crude oil industry is seeking a fundamental change is US having using advanced technology such as fracking to explore shale oil.

Not only the existing players are creating a threat to the OPEC production cut agreement. But new countries are also entering into Oil and Gas exploration which might not hamper much of the supply but would be able to create psychological fear in the OPEC.

Conclusion: These all factors would lead to further downfall in the price of crude oil and it may tumble to sub $35 levels in the long run. But it would be an advantageous situation for countries like India because we import crude and after the dynamic pricing issue one may expect a very short term downfall in the price of oil in our country.

share your thoughts

Only registered users can comment. Please register to the website.