Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIncorporated in 2009, Inox Wind (NSE:INOXWIND) is a fully integrated wind energy player. The company is a manufacturer of wind turbine generators and also provides turnkey solutions for wind farm projects. It has manufacturing plants in Himachal Pradesh, Ahmedabad and Madhya Pradesh with a cumulative manufacturing capacity of 1,600 MW. Till now all wind capacity in India was deployed using the feed-in tariff (FIT) schemes. However, the reverse auction scheme was introduced to lower the cost of wind power and foster higher competition amongst developers. This means that days of high IRRs and low competition in the Indian wind market will be a thing of the past now. This compounded with the removal of various incentives have led to a poor performance by Inox Wind. The company witnessed a falling order book in its most recent quarter. The stock performance was not very impressive too. I would, therefore, warn investors to be wary of this stock.

Inox Winds Headwinds

i) Challenges Faced by The Indian Wind Market Currently

One of the biggest challenges faced by the Indian wind energy players is the introduction of reverse auction. Wind turbine and wind developer margins will be under high pressure due to the competition created by reverse auctions. These auctions will wean out the weaker players from the industry. Inox Wind with no major competitive advantage stands a major chance of losing. Another big headache for the wind market in India is the abolishment of AD and GBI incentives. With these incentives now gone for good, wind energy in India has to pretty much compete on its own against the fossil fuel aka coal power.

ii) Competition From Solar Energy

The Indian wind industry is also facing immense competition from its renewable energy peer, solar energy whose prices have kept on declining at a rapid pace. States and governments are switching over to the cheaper solar energy to meet their renewable power obligation. Many of the erstwhile wind energy developers have successfully diversified into solar energy development. As such, wind producers are facing difficulty in signing PPAs with utilities for higher prices. Suzlon too has smartly diversified into solar, taking huge advantage of its EPC expertise and good relationships with power utilities.

iii) Rising Competition in Indian Wind Market

Inox WTGs are designed for low wind speed sites of India and the company manufactures three types of 2 MW WTG. Suzlon Energy on the other hand, has a wider spectrum of products to offer. Inox also provides turnkey solutions ranging right from wind resource assessment to maintenance of wind power projects.

Though Inox Wind is in advanced stages of creating the next generation of wind turbines and launching “Power Booster” technology, it still has a long way to go when compared to its western peers with a growing dominance in India. Inox Wind depends on its technology partner AMSC for its technical knowhow, whereas Suzlon has its own R&D team led by Germany. Suzlon, Vestas and Gamesa have recovered well from the global wind turbine industry downturn with record profits and margins.

Inox Wind’s only advantage was possession of huge land banks. But with reverse auctions in action now, landowners, developers and wind turbine makers who used to make an abnormal profit from the non-competitive wind energy farm development will feel the pressure. It is not much of an advantage now.

iv) Recent Performance was Miserable

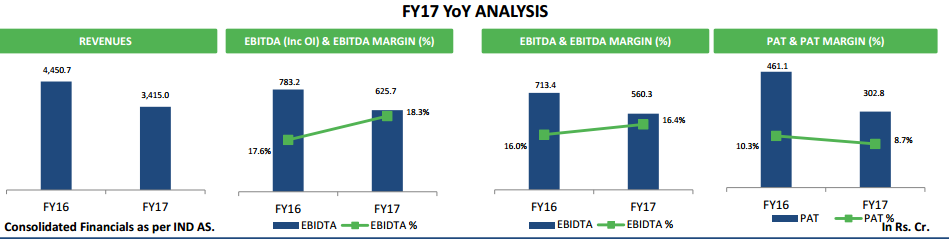

Inox Wind has faced issues with both a falling order book and a rise in receivables. The company reported quarterly operating profits declining by 23% when compared to the same period last year. The company has posted weaker results in the fourth quarter as well as overall FY17. The company’s performance was adversely affected by states abruptly refusing to sign PPAs after SECI auctions in February 2017. Suzlon, on the other hand, is showing a strong operational improvement and has managed to get out of its debt mess to a great extent.

Source: Q4’17 Presentation

Positives

India is the only Bright Spot

The Indian wind energy industry is looked upon as one of the bright spots globally when growth is slowing down in other parts of the world. The country has a target to install a total of 60 GW of wind capacity by 2022. The country installed a record-breaking 5 GW of wind capacity last year. This was not only the highest ever wind energy capacity installed in India but also 35% higher than the target of 4000 MW set by the Indian government. The total wind energy capacity in India is now touching 30 GW. The central government is expected to auction 4GW of capacity annually through SECI and state governments should auction 3GW.

Valuation

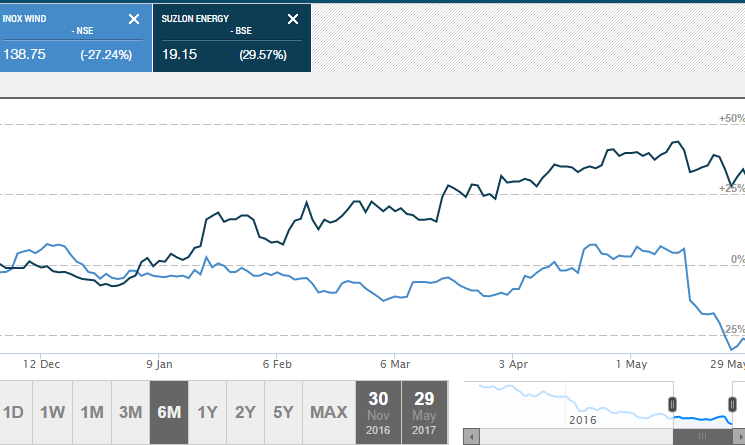

Inox Wind is trading near INR 136 level, which has declined by almost 19% after its dismal quarterly results. The company’s market capitalization value is INR 3,018 crores. The stock has tanked by more than 27% over the last six months. This is in stark contrast to its major peer Suzlon, which has shown a better performance returning over 36% to shareholders during the same time.

Stock Performance Comparison Inox Wind & Suzlon

Source: Moneycontrol

Conclusion

It is difficult for the wind industry to repeat the FY17 performance. The Indian wind energy players need to really exhibit a marked performance in terms of cost cutting and technology improvement if they want to remain relevant. Reverse auction will also enable international players entering the Indian wind landscape in a big way. Solar is also an increasing threat to the wind industry in India and major other Indian wind players have diversified into solar. Inox has witnessed a slowing order book and a downtrend in its operational performance. The stock performance was also unimpressive. The company needs to really buckle up and come out with some technological innovation to stay relevant. Investors should, therefore, exit and look for better prospects like Suzlon which is relatively cheaper too.

share your thoughts

Only registered users can comment. Please register to the website.