Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINState Bank of India (NSE:SBIN) is the largest commercial bank of India. It is a state-owned banking entity with the Indian government holding over 50% stake in the bank. State Bank of India commands over 20% of the Indian banking market share. The bank should benefit from the strengthening of the Indian economy with the passage of GST law. Furthermore, the center has given additional authority to the RBI for cleansing the balance sheets of large Indian banks and has also passed a bankruptcy law. With more than two centuries of existence, the State Bank of India has earned the faith of millions of customers across the Indian society. The bank is the largest in India in terms of assets, deposits, branches, the number of customers and employees. Recently the SBI entered into a merger agreement with five other smaller banks, which is expected to further improve the bank’s prospects. Its stock performance and valuation are also better than most large PSU banks in India. It is, therefore, a good time to invest in the stock.

SBI Positives

i) Extensive Presence

The State Bank of India has a huge and growing presence not only in India but also other countries worldwide. The SBI group has over 22,000 branches in India and over 190 offices in 38 other countries across the world. The bank had over 59,000 ATMs and 4.3 point of service terminals at the end of January 2017. The bank’s regional and asset diversification is very impressive. Its diversified asset portfolio includes domestic advances, commercial paper, corporate bonds, and FCNR loans.

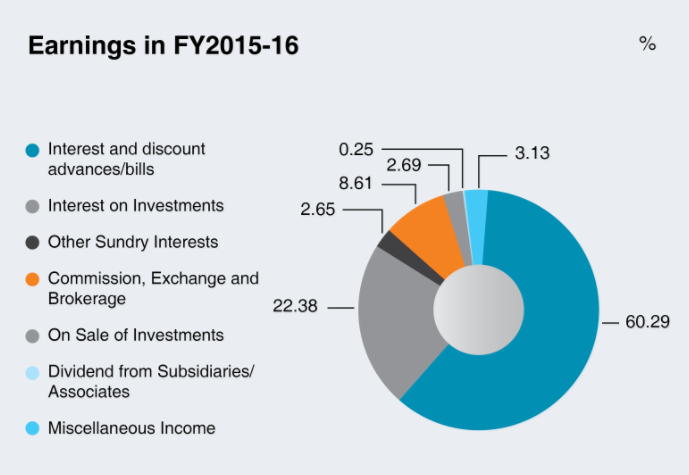

Source: SBI Analyst Presentation

SBI is also diversified across the industries, with infrastructure accounting for the largest sector with over 17% of the total size, followed by other sectors like services, iron &steel, petroleum, engineering, real estate etc. The banking company is also expanding digitally to become a dominant player in the digital space. Its web banking platform, Online SBI, is the fifth-most visited financial site, globally. Digital transactions accounted for over 22% of the total transactions. The State Bank Of India holds over 5.3 crore Pradhan Mantri Jandhan Yojana accounts and has a large presence in the Indian villages and remote locations.

ii) Wide Range of Services

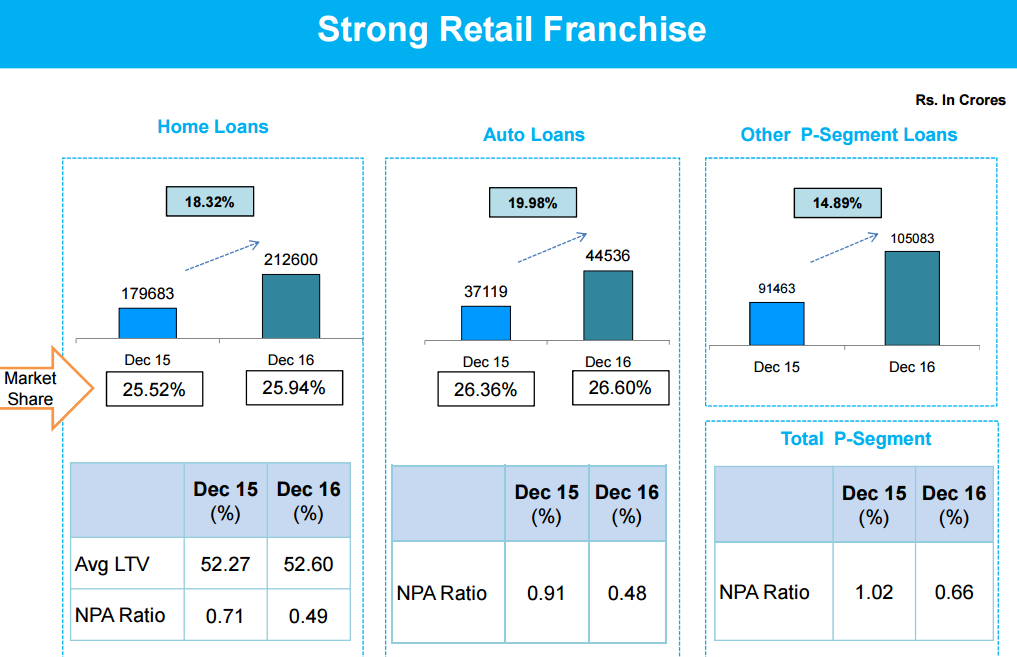

The bank provides a wide range of products and services personal & corporate banking, investment banking, life insurance, NRI services, general insurance, mutual funds, credit cards, factoring services, security trading, etc. As of 31st March 2016, the group had assets worth over USD 500 billion and capital & reserves in excess of USD 25 billion. The company has a strong retail franchise focus as is evident from the slide below.

Source: SBI Analyst Presentation

iii) Potential to rank amongst the Top 50 Global Banks

On April 1st 2017, State Bank of India merged with five of its Associate Banks (State Bank of Bikaner & Jaipur, State Bank of Hyderabad, State Bank of Mysore, State Bank of Patiala and State Bank of Travancore) and Bharatiya Mahila Bank. The combined SBI is expected to become a lender of global stature, with an asset base of INR 37 trillion, 22,500 branches and 58,000 ATMs, serving over 50 crore customers. This merger will also reduce geographical risks, increase efficiency and drive synergies across multiple locations.

iv) Improving Numbers

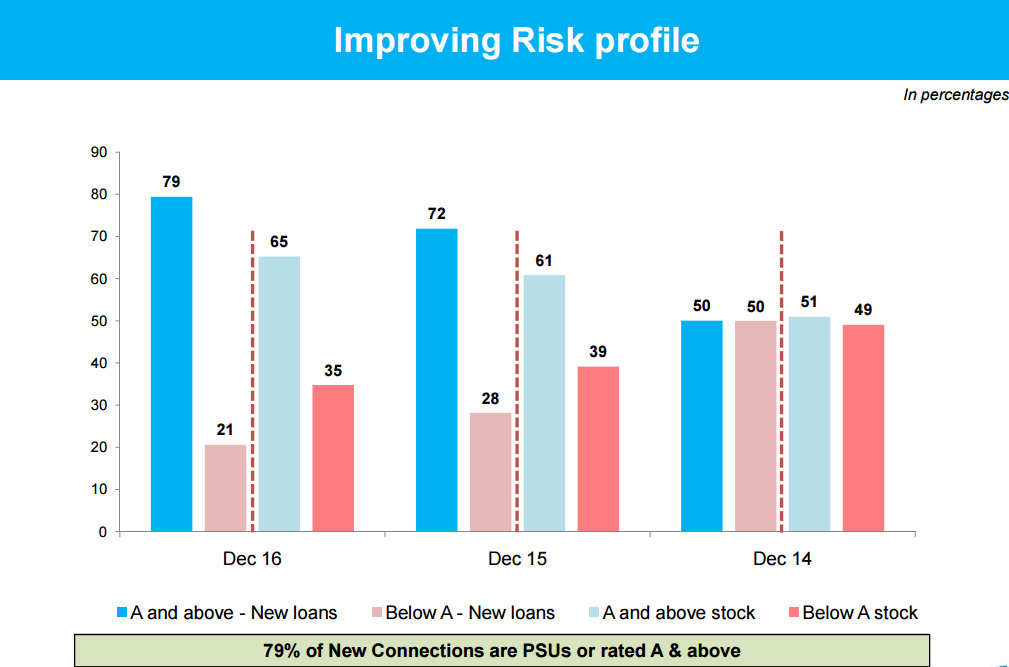

The State Bank of India declared its Q3’17 results, which showed an improvement in all the key metrics like net profit, operating profit, income and advances. It has also maintained a sustained CASA growth over the years. SBI’s risk profile has also improved greatly over the years.

Source: SBI Analyst Presentation

Challenges

Rising levels of NPA is the biggest concern for SBI. The company reported net NPA at 4.24% in December 2016 up from 2.89% a year ago. The mid-corporate segment is the largest area followed by large corporate, SME and agriculture segments. NPAs are having a huge negative effect on other banks as well. For example, ICICI Bank (NSE:ICICIBANK) which is amongst the largest private sector banks in India reported net NPA ratio at 3.96% as of December end. However, with the economy showing signs of a turnaround, SBI should start doing much better as could be seen from its last quarter’s numbers.

Valuation

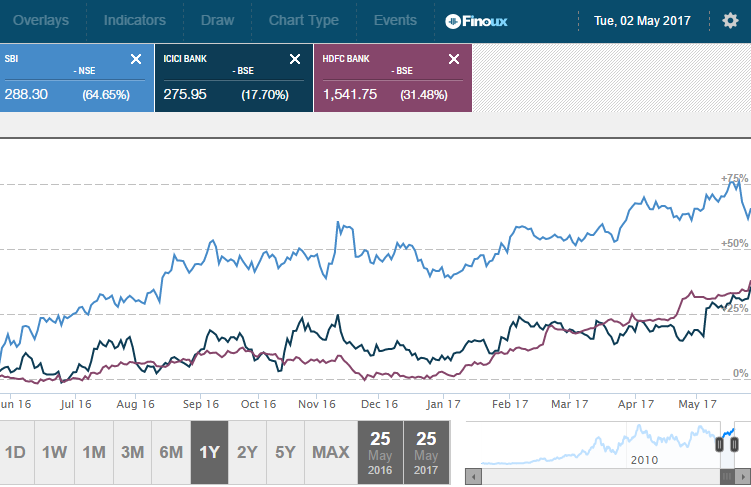

The stock is currently trading near INR 288 levels and has returned over 64% to its shareholders over the last year. The stock has a market capitalization value of INR 229,955 crores and trades at a P/B of 1.28x. It is undervalued when compared to HDFC Bank’s (NSE:HDFCBANK) P/B of 5.6x and ICICI Bank’s 2x. The one-year stock performance is also better than peers as can be seen from the image below. The valuations should further improve with a better Indian economy.

Source: Moneycontrol

Conclusion

State Bank of India is the largest bank of India having a substantive Indian and international presence. The banking company provides diversified products and services and also has a good diversification across industries. The only major concern is its high level of NPAs. However, that problem should be resolved in the near future after the merger. The bank’s EPS is estimated to grow 27% and 43% in FY17 and FY18. Moreover, the asset quality should also improve after the balance sheet clean-up last year. The company’s future thus looks promising with a strong Indian economy as State Bank of India is leveraged to the growth of the general economy. Though NPA is a big headache for the bank, conditions should improve with new regulations. The good performance of the latest quarter and reasonable valuations are also positives for the stock. I think it is a good time for investors to bank on the State Bank of India.

share your thoughts

Only registered users can comment. Please register to the website.