Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINMaruti Suzuki India Limited (NSE:MARUTI) is India's largest passenger car company, accounting for 48% of the domestic passenger vehicle market. It is a subsidiary of Suzuki Motor Corporation of Japan, which is a global leader in mini and compact cars. The company was incorporated in 1981 and has five plants in North India, with an installed capacity of over 1.5 million vehicles per year. According to IBEF, production of automobiles increased at 9.4% CAGR over the last decade. The company revolutionized four wheeler market in India by giving the country its first affordable car, Maruti 800. Today Maruti Suzuki has become a big brand name in India and offers a wide range of four wheelers to its customers and should further benefit from a rising demand and increasing product offering.

Maruti Suzuki Positives

i) Growing Geographical Footprint

Though the company has a dominating domestic presence, Maruti Suzuki also has a global footprint extending to other countries. The company has so far manufactured and sold over 7 million cars in India itself and exported over 500,000 vehicles to over 100 countries. Maruti is also looking at expanding further into foreign markets. In India too, the company has a nationwide service network spanning over 1500 cities and towns and an extensive sales network.

ii) Large product portfolio catering to all major segments

Maruti offers 16 cars in nearly 150 different variants for different segments. Starting with Maruti 800, the company has today grown its product portfolio to include Alto 800, Alto K10, Wagon R, Celerio, Ritz, Swift, DZire, Ertiga, Omni, Eeco, Gypsy and Ciaz. The company recently relaunched the Dzire sedan and has also launched Ignis, India’s first premium urban compact vehicle. With years of experience in the automobile industry the company has developed deep insights into the consumer market. Maruti’s cars have evolved in terms of design, innovation, technology and features. This has enabled Maruti to retain leading position in the passenger vehicle segment in India.

iii) Trusted Brand Name

Today, the Maruti Suzuki brand name exudes trust, product quality and safety. It is widely preferred by people for its affordability, power and performance. Maruti cars also have a backing of the Japanese Suzuki brand which is known for its superior performance and excellent track record in the automobile industry. Not only India but other international markets too are celebrating Maruti’s success and craftsmanship. During 2015-16, Maruti Baleno became the first Indian car to be sold in Japan, which is considered the most quality conscious automobile market.

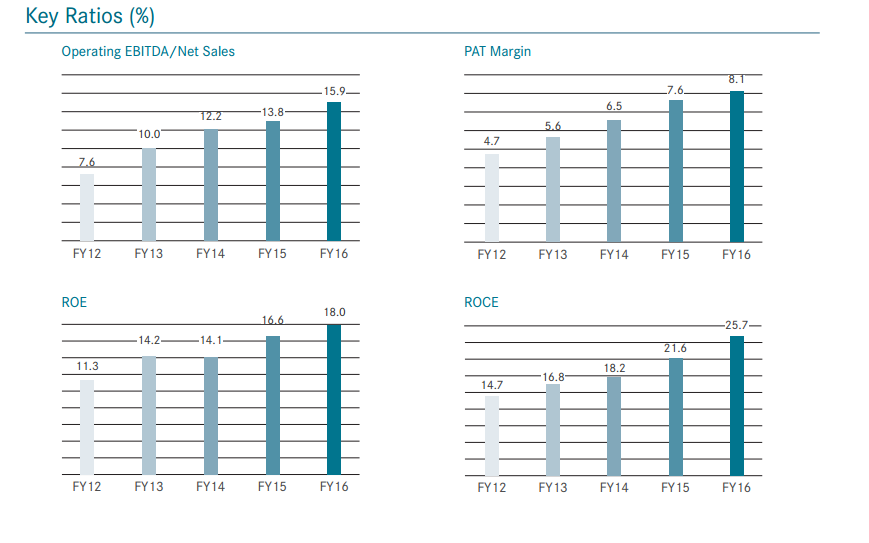

iv) Numbers indicate growth

The year 2016-17 marks a robust growth of 9.8% in car sales totaling to 1,568,603 units. This includes the highest ever domestic sales. Net sales increased by 18.5% and net profit showed a 36.8% growth. Maruti has been a consistent performer growing both sales and earnings per share in the past.

Source: Maruti Annual Report

Maruti reached the 1 million annual sales mark in 2009-10 itself and now aims to touch the 2 million annual sale mark by 2020. The company is also pioneering into new premium sales channel Nexa, AGS (Auto Gear Shift) and SHVS (smart hybrid vehicle) technology to stand out from peers in a hyper-competitive market. Maruti also has a robust product pipeline (3rd generation Dzire as also the all-new Swift hatchback expected to be launched this year) and plans to launch 15 new models by 2020.

Challenges

The Indian car market is crowded. There are many leading car companies fighting for grabbing the marketshare. Tata Motors, Hyundai, Mahindra, Honda and Toyota are other prominent players in this sector. Though Maruti leads the passenger vehicle market in India, competition is catching up. With rising concerns over pollution the Indian government is emphasizing upon using self-driving cars in a big way. Maruti thus needs to come out fast with a competitive car in this segment. Mahindra has already entered this space and is fast gaining traction. It has already collaborated with leading taxi companies like Ola in India to run its Electric car variant as cabs in India.

Maruti Suzuki was questioned for its lack of creativity and capacity constraints. But it looks like Maruti has outsmarted the industry experts. Last year’s launches Baleno and Vitara Brezza have been quite successful; with latter’s unit sales already reaching the 1 lakh milestone. Its Gujarat plant is also expected to manufacture 10,000 units a month from May this year.

Valuation

The stock is currently trading at near INR 6,790, which is just 3% below its 52-week high price. The stock has returned more than 70% in the last year, which is also better than Tata Motor’s (NSE:TATAMOTORS) stock that returned 15% during the same time. Tata Motors has a market cap value of INR 150,419 crore which is less than Maruti Suzuki’s INR 205,047 crore showing that the market has priced in the company’s strength in the industry.

Conclusion

Maruti’s extensive network and partnership built over the years, its innovation ability and a strong customer focus are its biggest competitive advantages. The company has fortified its position in the Indian market and is fast expanding in other international key markets as well. The Indian auto industry is one of the largest globally and Maruti is its undisputed leader. India is a fast growing economy with its GDP expected to grow in the coming years. Hence, the company should benefit from a growing Indian car market. Maruti holds 48% of the total car segment marketshare in India, followed by Hyundai which commands just 18% while rest account for the remaining 34%. Though valuations seem high, the company is well positioned to capitalize on a growing Indian market and an expanding export base. Investors may look at adding the stock at dips.

share your thoughts

Only registered users can comment. Please register to the website.