Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

India has become an emerging market favourite amongst stock investors owing to a politically strong and stable federal government, implementation of crucial economic and structural reforms (GST, JAM, ease of doing business) and a stable currency. The country is also a net beneficiary of falling commodity prices. According to the Economy Survey, the GDP is expected to grow at 7% next year. India's currency and markets have remained extremely stable in the face of global volatility.

As the second largest Indian private bank by assets, HDFC Bank (NSE:HDFCBANK) is a safe way to invest in the long term secular growth of the Indian economy. The bank offers one of the best ways to invest in the banking sector owing to its large retail focus and low NPA levels. HDFC Bank has continued to perform through both the ups and downs of the economic cycle and has been a multi-bagger over the last couple of decades. Mr. Aditya Puri has been the MD of the bank since its inception in 1994 and has played a vital role in the success story of the bank.

Why should you buy HDFC stock

i) Good Quarterly Performance and best asset quality

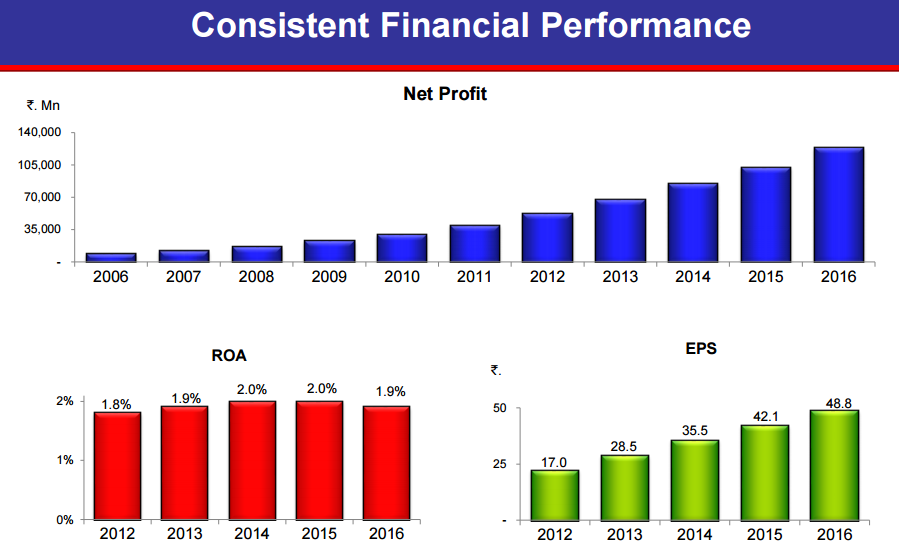

HDFC reported better than expected financial results for the quarter ended March with net profit increasing by 18% compared to the same quarter, a year earlier. The bank managed to increase its profitability amid deteriorating asset quality of the overall banking sector. The bank has been performing astounding well, keeping its NPA level at just 0.3% as of March end compared to 0.32% as of December.

This compares with the 5-10% NPA levels being reported by its competitors. HDFC has a strong retail focus and relatively less exposure to project finance. The company’s relentless focus on credit quality and loan due diligence has been the key competitive advantage that has led it to weather the vagaries of the economic cycle.

Source: HDFC Investor Presentation

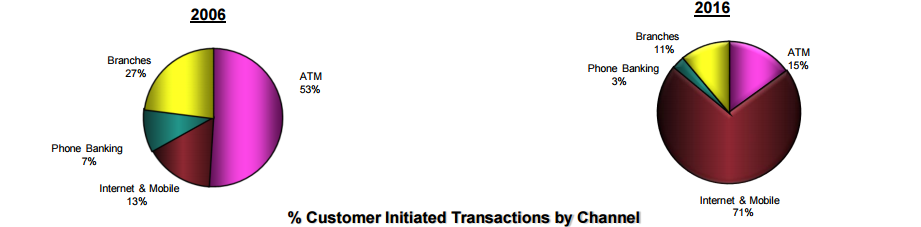

ii) Increased Online and Digital presence

Demonetization has helped the bank to increase its digital transactions. The Internet and mobile banking transactions accounted for 71% of the total transactions in FY16 compared to 63% in FY15. The bank has launched several innovative products on the digital platforms including 10-second personal loan, payment apps Chillr and Payzapp, Smartbuy platform.

Source: HDFC Investor Presentation

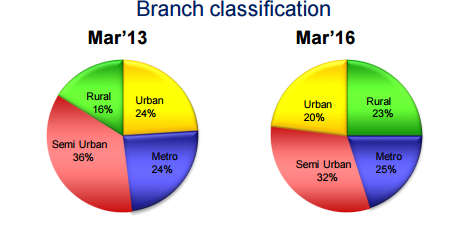

iii) Presence in most rural parts of India

HDFC also has a growing presence in semi-urban and rural India. About 60% of the total new 500 branches expected to be launched this year, would be in these areas. Currently, the bank has more than 4,200 branches and over 12,000 ATMs, linked on an online real-time basis. Other than these, there are other multiple delivery channels such as Phone banking, Net banking, Mobile banking and SMS based banking.

Source: HDFC Investor Presentation

Challenges

a) Growing Competition

India’s banking sector is very competitive with many public and private banks. The Indian banking system consists of 26 public sector banks, 25 private sector banks, 43 foreign banks, 56 regional rural banks, 1,589 urban cooperative banks and 93,550 rural cooperative banks, according to IBEF. Public-sector banks control nearly 80% of the market. The number of small finance and payments banks is also poised to increase over the next few years with new banking licenses being issued. In FY 2014-15, 23 banking licences were granted to new players by the RBI. This creates immense competitive pressure for private banks like HDFC in India.

b) Reducing CASA Ratio

HDFC Bank is also facing the problem of mobilizing its low-cost deposits - current account and savings account (CASA). Banks have been offering higher interest rate of 5%-7% to get market share, since the RBI deregulated the savings rate. However, banks like HDFC cannot afford to offer higher rates as it would increase their cost of funds and margins. As such, HDFC Bank's CASA has been declining gradually over the past few years. It stands at 40% currently from 43% in March 2016 and 48.4% in March 2012.

Valuation

The stock is currently trading near INR 1,530 levels and has returned around 33% to its shareholders over the last year. The stock has a market capitalization value of INR 2,432 billion and trades at a P/B of 4.8x, which seems quite high when compared to ICICI Bank’s (NSE:ICICIBANK) P/B of 1.7x. HDFC’s stock performance has also been better than ICICI. Though HDFC bank has a high valuation ratio, it is justified in my view owing to its top-quality management, high growth rate and great asset portfolio.

Conclusion

The banking sector plays an important role in the economic development of a country and a country’s rate of economic development greatly affects a bank’s business. HDFC being the most valued bank in India is all set to grow at a rapid pace as the financial sector generally grows at a faster pace than a country’s GDP. HDFC bank is the bluest of blue chips in the Indian stock market and also one of the safest Indian stocks to hold during a down cycle. With the Indian economy expected to stabilize and grow following the demonetization drive and reforms like the GST, the bank should also deliver better returns to its investors. Investors should look at buying on dips.

share your thoughts

Only registered users can comment. Please register to the website.