Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINTata Power Company (NSE: TATAPOWER) is India’s largest private sector power company having a presence in all the major segments of the power sector and serving more than 2.6 million distribution consumers in India. The company has a history of generating electricity over the last nine decades in India. The company is part of renowned Tata Group which is a leading business conglomerate in India having a presence dating back to 1868. Tata Power is also one of the largest renewable energy players in India with a clean energy portfolio of 3060 MW. The company has total installed generation capacity of 10496 MW and operates in two business segments - Power (generation, transmission and distribution of electricity) and Other (electronic equipment, project consultancy). It also has a growing international presence in Middle-East & Turkey, Sub-Sahara Africa, SAARC and South East Asian countries.

Tata Power stock performance and valuation are attractive than its peers and given the increasing demand for power in India, the company is a good stock to own over the long term.

Why Should You Invest in Tata Power

1) Part of The Tata Group – Tata Power enjoys a strong reputation built over the years. Tata Power was named as world’s most ethical company in 2016 by the Ethisphere Institute for the third consecutive year. As a part of the Tata Group, Tata Power’s values ethics highly. The objective of Tata companies is long-term value creation for its shareholders and the company has been paying and increasing dividends consistently over the years.

2) Extensive & Diversified Power Portfolio – As the largest private power utility in India, the company has a significant presence in generation (diversified across thermal, hydro, solar and wind), transmission and distribution of electricity. Tata Power owns some of the country’s largest power plants such as the Trombay, Mundhra, Maithon and Jojobera power plants. Thermal power generation capacity accounts for 70% of total capacity and remaining 30% comes from non-fossil sources. Coal is facing immense regulatory pressure globally. Therefore, the company is taking measures to increase non-fossil based component in its portfolio. Coal business is no longer reported as a separate business segment. Tata Power’s diversified portfolio should thus safeguard the company from any negative effects of the changed power paradigm.

3) Leading Renewable Energy Player In India – Tata Power is rapidly expanding its renewable energy portfolio. Renewable Energy especially solar power is growing at a fast pace not only globally but also in India. The country has set a target to install 100 GW of solar power by 2022 and Tata Power should benefit from this growing trend. Tata Power Solar is amongst the country’s largest solar manufacturers with a production capacity of 300 MW of modules and 180 MW of cells. It acquired Welspun Renewables last year to further strengthen its renewable energy portfolio. Tata Power Renewable Energy Limited (TPREL) is Tata Power's primary investment vehicle for clean and renewable energy. Tata Power's RE generation crossed 51,000 MUs for the first time in FY17.

4) Should benefit from rising trends of power consumption in India - The demand for power will keep on increasing in India. Tata Power has a large distribution customer base of over 18 lakh customers in Delhi and Mumbai. The company has immense potential to grow as India's largest integrated power company. The power sector in India recently witnessed the passage of several initiatives under UDAY scheme which are expected to improve the current power situation going forward.

Valuation

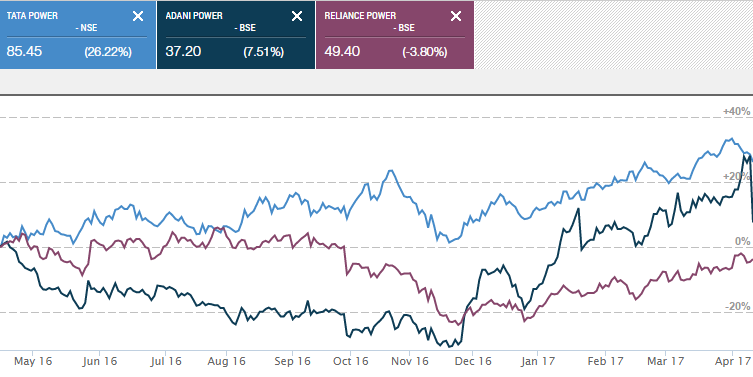

Shares of Tata Power Company are currently trading near INR 85 which very close to its 52-week high price. The stock performance has been good as it returned 26% over the last year. The company has a market cap value of INR 231 billion and a P/E of 16.8x. The P/B ratio which is a better metric for power companies is 1.56x for Tata Power Company which is lower when compared to Adani Power’s (NSE:ADANIPOWER) 1.62x and NTPC’s (NSE:NTPC) 1.53x. The stock performance has also been better than its peers over the last year as can be seen from the graph below.

Source: Moneycontrol

Challenges

The Indian power sector suffers from structural regulatory and policy issues which has long stunted the growth of the industry. The state distribution utilities are in a perpetual state of mess. They have massive accumulated losses and are unable to buy power from generators in a timely manner. Some segments such as agriculture get free electricity leading to massive losses and corruption.

Overcapacity in power has become a new problem for Indian power companies as the country is in a state of “artificial surplus”. It has become hard to sell power without a PPA and many thermal power plants have become stranded. However the company is in a better position to face these challenges than most of its peers. The recent adverse ruling by the Supreme Court in case of the tariff increase for the Mundra plant did not affect the stock price too much as it was already been priced into the stock.

Conclusion

Tata Power has significantly enhanced its renewable energy portfolio which should benefit the company over the long term. India has one of the lowest per capita consumption of power (approximately 1/3rd of global average) and a large chunk of it population still lives in darkness. Though the power market is currently facing headwinds due to a power surplus condition in India, the conditions should improve through various economic reforms by the government like 100% electrification program, UDAY, Make in India, Power for All and rural electrification. India’s power sector will be the best place to invest in given the huge untapped potential in rural areas. Being amongst the top few private power players in India, Tata Power will be a good way to play the secular growth in power demand. Investors should buy the stock on dips.

share your thoughts

Only registered users can comment. Please register to the website.