Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINThe Indian IT industry is suffering from a general slowdown driven by increased global competition, a strengthening Indian rupee, and headwinds from Trump’s tightening of H1B visa regulations. The industry has now entered a phase where it is has matured and slowed down to high single digit – low double digit range. Indian IT companies need to devise new solutions and products to remain relevant in the current global scenario where AI and automation are reducing the need for low-cost Indian IT labour.

Infosys (NSE:INFY) is India’s second-largest software firm and has a presence in more than 50 countries around the globe. It was a pioneer in establishing India as a hub of IT services outsourcing and was followed by a number of other homegrown companies such as Wipro (NSE:WIPRO), Tata Consultancy Services (NSE:TCS), Cognizant and others. The company has shown a turnaround and also beat analyst growth expectations under the leadership of its CEO Vishal Sikka. However, Infosys again faces problems which have led to overall slowdown and a tepid growth rate. Though most issues are generic to the industry at large, it is also facing the increased public scrutiny of executive compensation from its founders and key shareholders. Despite these issues, I feel that Infosys stock should be part of an IT investors’ portfolio given its futuristic platforms, strong operating results, and a dynamic management team.

Infosys Positives

1) Q3 Results reflects strong operational efficiency

Infosys reported a 2.83% increase in net profit to INR 37.1 billion for the December quarter which was better than analyst expectation of INR 35.57 billion and last quarter’s net profit of INR 36.1 billion. The company crossed the $10 billion mark in revenues during the calendar year 2016 but lowered its FY17 revenue guidance to 8.4%-8.8%, compared with 8%-9% earlier in constant currency terms.

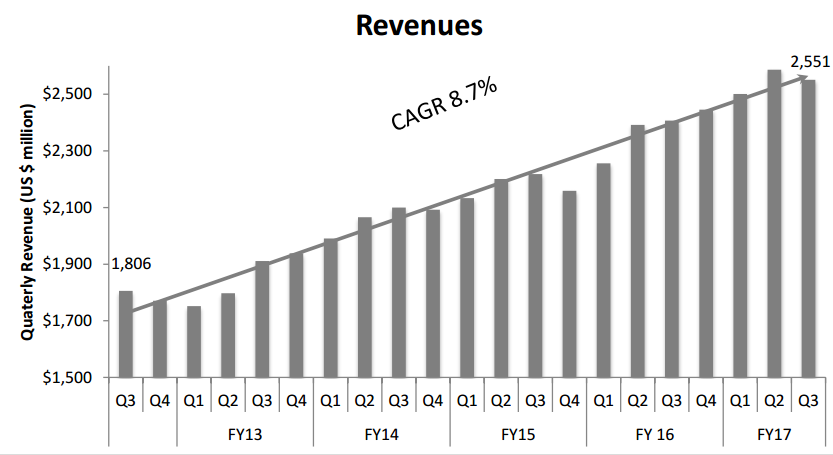

It also reported a utilisation rate of more than 81% which was the highest ever third quarter rate. Its new initiatives (Mana, Skava, Edge, Panaya) in software-led services reported strong growth. Based on increased focus on AI-led automation and operational efficiency, revenue per employee also increased to $51,900. The company posted a growth rate of 9.4% in the first nine months, in constant currency terms. Infosys has a major presence in Europe which showed a growth of 1%, US down (-0.6%) and rest of world down (-1.5%) QoQ. The company has grown revenues at 8.7% CAGR in the last five years and maintained high margins based on the flexible cost structure.

2) Expected to Grow Under Sikka

The CEO, Vishal Sikka has successfully steered the company through tough times and Infosys should exhibit future growth driven by its focus on automation and operational efficiency. Vishal Sikka has been a good CEO for Infosys, and moved the company to higher than the industry growth trajectory. Some of the impressive organisational transformations that took place under Sikka are increased focus on automation, artificial intelligence and digital technology. His new project called “Zero Distance” has made communication much easier and reduced the five layered organisational structure into a two-tiered one.

3) Should benefit from various new Revenue generating initiatives

Infosys has a strong brand recall as is evident from the fact that the company was awarded the prestigious five-year GSTN (Goods and Service Tax Network) project in September last year to develop the necessary infrastructure for GST implementation in the country. This should boost the company’s revenues once GST is in place in India. The project is worth INR 13.8 billion and should contribute towards Infosys’ future growth. Furthermore, AI adoption should also drive revenue growth for businesses going forward. Infosys has diligently expanded its services footprint since 1981 to present day. The company has a target to reach $20 billion in revenues, 30% margin and $80,000 revenue per employee by 2020.

4) H1B Visa restrictions, not a major headwind

The controversy around restrictive policies being imposed on H1B visas should not adversely affect Infosys much as the company has a policy of hiring local US citizens. Infosys’ visa-free global delivery model should further shield the company from any other ill-effects. Though there will be changes to the H1B policy, the CEO is confident about President Trump’s innovative and entrepreneurial ideologies, and business success.

According to Vishal Sikka, “Trump is himself an entrepreneur and has a very business friendly, innovation-oriented background. So I expect that the policies of the administration are going to be friendly towards business”.

Source: Infosys

Challenges

Infosys suffers from major challenges like economic and regulatory uncertainty, pricing pressure, volatility in global IT spending etc. Infosys growth rates have slowed down in line with the rest of the industry and its 2020 target looks difficult to achieve. The industry at large is suffering from negative cross currency impact. The Indian rupee has strengthened by 4.5% last month alone which has become a major headwind for IT companies. Moreover, Infosys has not made a single acquisition in the last year. In contrast, Wipro Ltd (NSE:WIPRO) is strengthening its product offering by making numerous acquisitions over the last two years.

Valuation

The valuation looks reasonable when compared with peers. The stock is currently trading near INR 1,000 and has lost 17% in the last year. Infosys has a market capitalization of INR 2,317.6 billion and a P/E of 16x which is cheap when compared to the industry average P/E of 18.8x.

Source: Money Control

Conclusion

The growth of the Indian IT industry has stalled due to changing technology trends and also due to the size effect. Indian IT companies have become just too big to clock 20% plus annual growth rates through their normal “bodyshopping” model. However, Infosys, based on its innovation and automation approach should be a good company to invest for a long-term investor. Despite lower revenue growth, the company successfully posted high operating as well as net margins. The CEO has been pushing hard to achieve the herculean task of transforming the organisation’s DNA from a bodyshopping model into an innovation, lean and agile model. The company also remains optimistic about the fourth quarter BFSI segment growth. Infosys has delivered revenue growth, high shareholder returns and dividends over the past years. The stock is currently trading at 21% below its 52-week high price and offers a good entry point to investors.

share your thoughts

Only registered users can comment. Please register to the website.